Rollforward - Tags/Classes

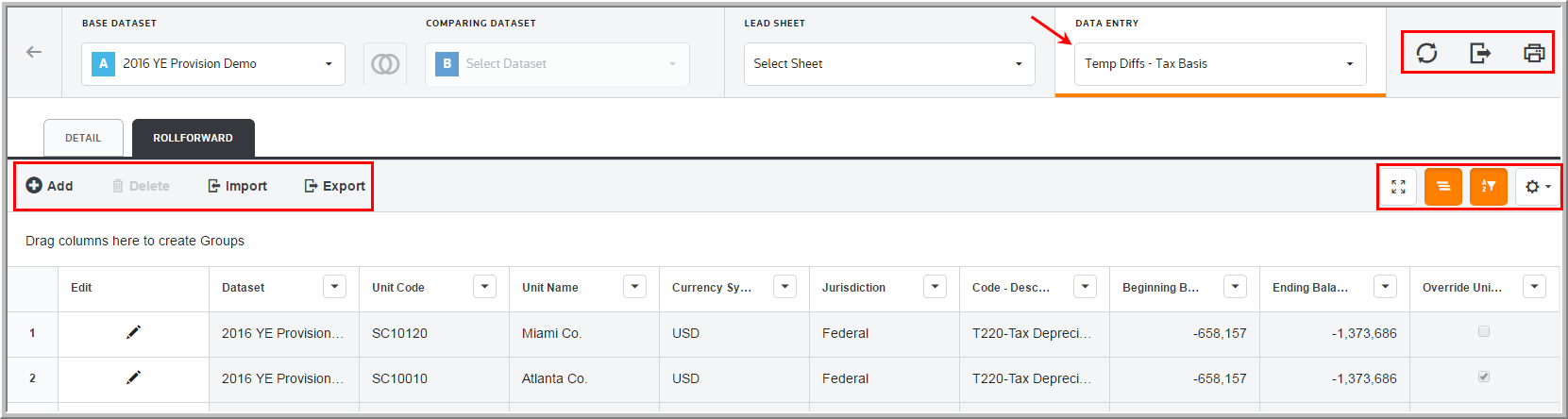

In Temporary Differences - Tax Basis and Temporary Differences - Book/Tax Basis, you can enter data in the optional fields available within the Rollforward tab. Here you can refresh, export (informational purposes), print, add, edit, delete, import, export (template) data.

TAG DATASETS

It uses the Dataset level Manage Deferred Rollforwards page to set a default tag and type when data is entered. Data entered in the Rollforward section is translated using the Deferred Entry Set-up default rules and posted in the Detail section with the appropriate Tag and Deferred Type.

•Click the +Expand link to display a preview of the Deferred Balances report (pre-tax). The column headers are those established in Dataset Administration Manage Deferred Rollforwards.

•The OTHER ENTRIES row populates all items entered in the Detail section that cannot be uniquely classified because of multi tags or multi-type entries in Manage Deferred Rollforwards.

•To display the data entry section, click Create New or Edit.

•If you choose Use Ending Balance for a Code, the Ending Balance Override option is automatically selected in the Rollforward section. You can edit the Ending Balance for book and tax.

CLASS DATASETS

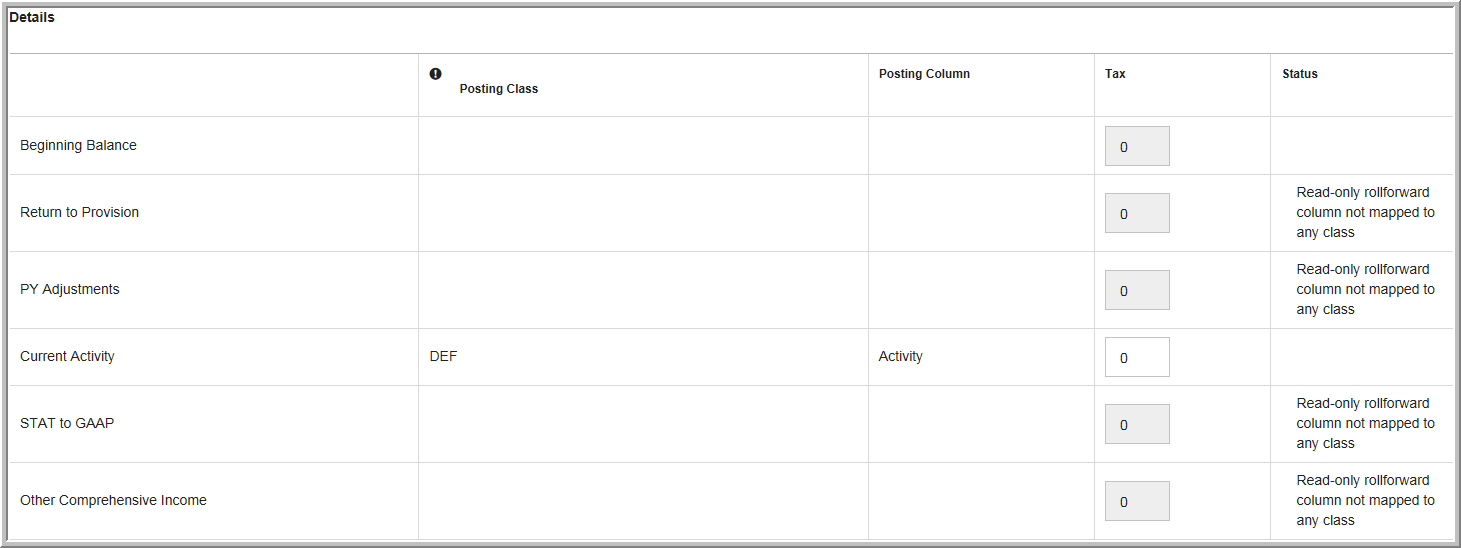

It uses the Dataset level Manage Deferred Rollforwards page to set a default class and adjustment type when data is entered. Data entered in the Rollforward section is translated using the Deferred Entry Set-up default rules and posted in the Detail section with the appropriate "Posting Class" and "Posting Column."

•Click Expand to view all columns on the Deferred Balances report (pre-tax). The column headers are those established in the Dataset level Manage Deferred Rollforwards screen.

•Click Add or Edit to enter data.

•Choosing Post to Ending Balance for a Code enables you to edit the Ending Balance for book and tax.

Temp Diffs - Tax Basis - RollForward

Temp Diffs - Tax Basis - RollForward Details

Data Entry Fields - Rollforward

The grid lets you enter amounts and select options from the drop-down lists. You can use the tab key to move between the fields much like an excel worksheet.

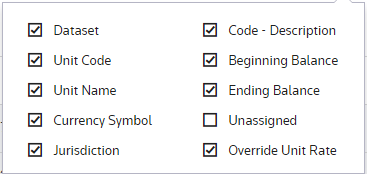

The Temporary Differences - Tax Basis and Temporary Differences - Book/Tax Basis component grid includes the following columns. See Data Table for more information about the grid options.

TAG DATASETS

Edit

Edit lets you edit the data for the adjustment. Click ![]() to add an attachment.

to add an attachment.

Dataset

The Dataset selected in the Base Dataset drop-down list.

Unit Code

The Unit Code is established by an Administrator for the Temp Diffs - Tax Basis.

Unit Name

The Unit Name is established by an Administrator for the Temp Diffs - Tax Basis.

Currency Symbol

The Currency Symbol is established by an Administrator for the Temp Diffs - Tax Basis.

Jurisdiction

Jurisdiction lets you select the jurisdiction for an adjustment.

Code - Description

The code and description are established by an Administrator for the temporary difference.

Beginning Balance

Beginning balances are read-only.

Type

There are two types of temporary difference balances - Current and Non-Current. Select the type that best relates to the balance sheet account where the deferred tax asset or liability should be represented.

Override Unit Rates

You can override the unit rates designated under Unit Details for a specific temporary difference line by clicking the Override unit rates check box.

Book Amount

Enter the Book amount. The system displays the Tax-Book Difference based on how it should display in the Deferred Rollforward name listed.

Tax Amount

Enter the Tax amount. The system displays the Tax-Book Difference based on how it should display in the Deferred Rollforward name listed.

CLASS DATASETS

Unit Code

The code is established by an Administrator for the temporary difference.

Unit Name

You can select the Temp Diff Code - Name.

Override Unit Rates

You can override the designated unit rates for a temporary difference.

Beginning Balance

Beginning balances are Read-Only.

Unassigned

Type the unassigned balance in the Tax column for the Deferred Rollforward column.

Ending Balance

Ending balances are Read-Only.