Current/Non-Current

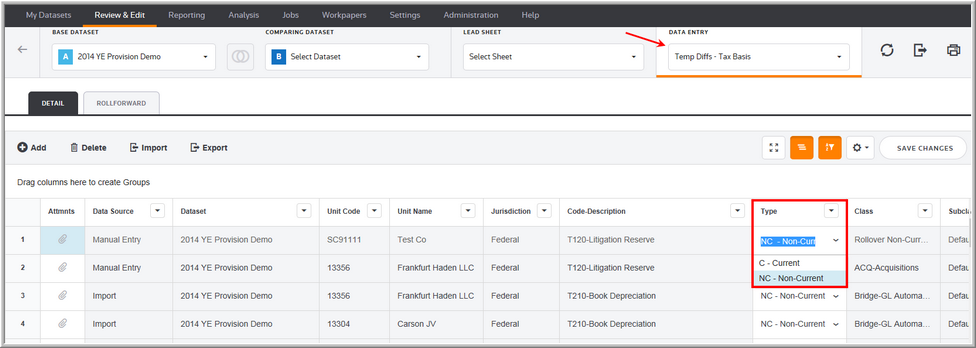

For entries that impact the deferred tax accounts, you must designate them as either Current or Non-Current.

In Data Entry, for Temporary, NOL Temporary and After Tax Temporary Differences select C - Current or NC - Non-Current.

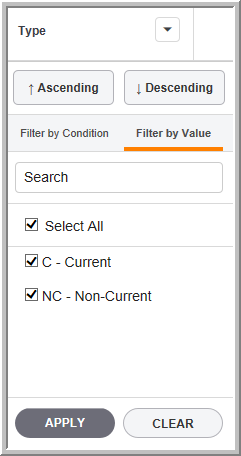

Current or Non-Current List

You can filter Deferred balances and NOL balances to view current and non-current balances separately.

Current or Non-Current Type

You can review the temporary difference summary report for the current and non-current balances by asset and liability.