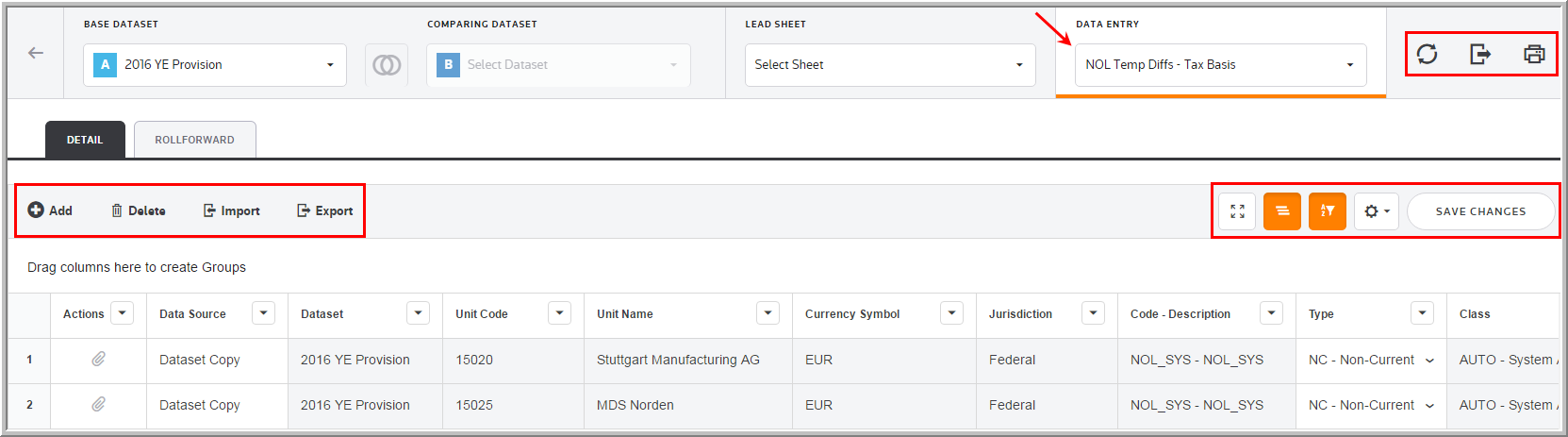

NOL Temporary Differences - Tax Basis

In the Data Entry list, you can select the NOL Temporary Differences - Tax Basis component to enter federal and jurisdiction data. In the NOL Temporary Differences - Tax Basis page, you can refresh, export (informational purposes), print, add, edit, delete, import, export (template), group columns, show/hide columns, and filter your provision and estimated payment data. There are two tabs available to enter your data: Detail and Rollforward.

Note: Tax Basis Temporary Difference screens allow you to enter amounts as purely tax balances, with or without book or net of book.

Provision and Interim (Actual section) datasets only

•There are two sections: Detail and Rollforward. By default, the Detail section displays first. All users can enter and modify data in both sections, also by default. Administrators can use the DEFAULT_TD_TAB and RESTRICT_TD_TABS dataset parameters to change the section that displays by default and determine whether or not Read/Write users can enter data in the Details section.

•Data entered in the Detail section is translated using the Deferred Entry Set-up default rules and displays in the Rollforward section.

•For information on the Rollforward section, go to the Rollforward page.

All Datasets

•The Activity, Deferred, and Balance Sheet Only column amounts impact the tax provision differently.

•Each NOL temporary difference line defaults to being tax effected using the unit rate. The beginning and ending unit rate can be overridden on a line-by-line basis. If only the beginning or ending rate is overridden, you must populate the fields. If a field is not populated, it defaults to a zero rate.

•The NOL temporary difference can be automated to take the generated or utilized net operating loss impact.

•To import information to the NOL Temporary Differences - Tax Basis screen, complete the appropriate fields on the #UNOLTD# Unit NOL TDs-Tax Basis sheet in the Import Numbers template.

•If you wish to adjust the same NOL temporary difference more than once, you must make additional entries using different tag letters or classes.

Note: To use default unit rates, enter U in the rate columns when importing. For more information on importing, refer to the Importing Templates documentation.

Import Template

To import information to the NOL Temporary Differences - Tax Basis page, complete the appropriate fields on the #UNOLTD# Unit NOL TDs-Tax Basis sheet in the Import Numbers template.

See Data Entry Import for more information about the NOL Temporary Differences - Tax Basis data import process.

NOL Temporary Differences - Tax Basis

Data Entry Fields

The grid lets you enter amounts and select options from the drop-down lists. You can use the tab key to move between the fields much like an excel worksheet.

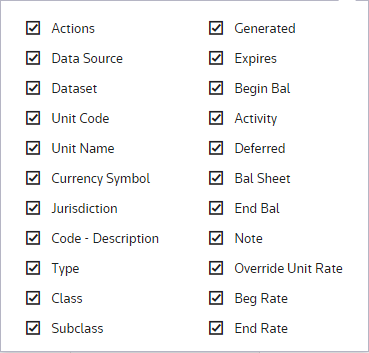

The NOL Temporary Differences - Tax Basis component grid includes the following columns. See Data Table for more information about the grid options.

Actions

Actions allow you to supplement the adjustment with detail. Double click ![]() to add an attachment.

to add an attachment.

Data source

Data Source enables you to view the Data Source History.

Dataset

The Dataset selected in the Base Dataset drop-down list.

Unit Code

The Unit Code is established by an Administrator for the NOL Temporary Differences - Tax Basis.

Unit Name

The Unit Name is established by an Administrator for the NOL Temporary Differences - Tax Basis.

Currency Symbol

The Currency Symbol is established by an Administrator for the NOL Temporary Differences - Tax Basis.

Jurisdiction

Jurisdiction lets you select the jurisdiction for the adjustment.

Code - Description

•The code and description are established by an Administrator for the NOL temporary difference.

•Automated NOL amounts are posted to a code that begins with NOL_SYS.

Type

There are two types of NOL temporary difference balances - Current and Non-Current. Select the type that best relates to the balance sheet account where the deferred tax asset or liability should be represented.

Tag

The tag letter identifies each line entered in the originating source.

Class

The class identifies each line entered in the originating source.

Subclass

The subclass identifies each line description entered in the originating source. You can select Next Value as the subclass and the application generates the next "Code" number for the selected Code, Type and Class.

Generated

Tracks the year the NOL was generated.

Expires

Tracks the year the NOL is expected to expire.

•The expiration year is a place holder.

•The application does not automatically delete NOLs from reports in the expiration year. You must manually remove the NOL from the application.

Beginning Balance

•The cumulative temporary difference balance rolls forward from the prior dataset. You can replace the beginning balance with a manual entry or by importing.

•The administrator has the ability to lock beginning balances preventing "Read/Write" users from entering data into the Begin Bal column.

Activity

•Activity impacts the current and deferred provision, as well as deferred balances.

•Positive amounts increase and negative amounts reduce the taxable income.

•Amounts are entered in local currency and translated to the reporting currency using the unit's weighted average FX rate.

Deferred

•Deferred impacts the deferred provision, as well as deferred balances.

•The entry is used for the impact of valuation allowances or adjustments to prior year balances.

Balance Sheet

•Balance only impacts deferred balances.

•Typically this entry type is used for the impact of equity or other comprehensive income items.

•The Balance Sheet Only (BSO) adjustment on the Tax Provision report removes the BSO Adjustment from the Deferred Provision.

Note

You can type notes to supplement the adjustment. You can access a history of the Notes within "Data Source History."

Override unit rates

You can override the unit rates designated under Unit Details for a specific temporary difference line by clicking the Override unit rates check box.

Notes:

•The Default Type is NC-Non-Current.

•The Default Type is set by an administrator and the ability to select C -Current and NC -Non-Current may not be an option.

•The administrator can deviate from the Default Type and allow you to select between C -Current and NC -Non-Current.

•The Temp Diffs Discrepancy report will be available to review the Temporary Differences - Tax Basis that have been overridden and deviate from the default type set up by the administrator.

•Please contact your Administrator if you have questions about the Default Type set up.