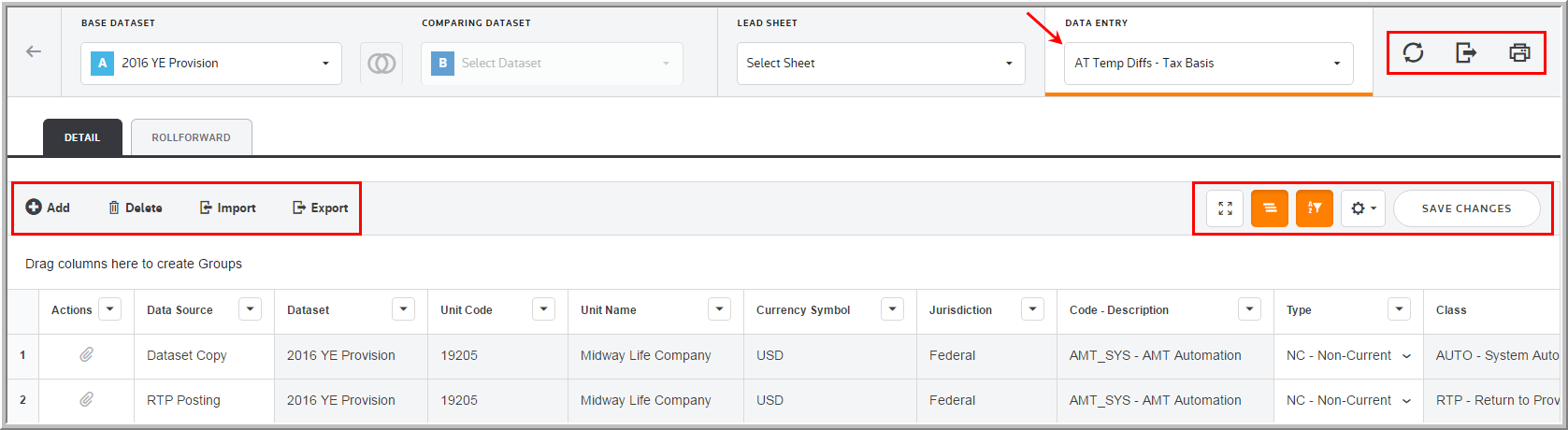

After Tax Temporary Differences -Tax Basis

In the Data Entry list, you can select the After Tax Temporary Differences - Tax Basis component to enter federal and jurisdiction data. In the After Tax Temporary Differences - Tax Basis page you can refresh, export (use for informational purposes), print, add, edit, delete, import, export (template), group columns, show/hide columns, and filter your provision and estimated payment data. There are two tabs available to enter your data: Detail and Rollforward.

For each component,

Note: Tax Basis Temporary Difference screens allow you to enter amounts as purely tax balances, with or without book or net of book.

Provision and Interim (Actual section) datasets only

•There are two sections: Detail and Rollforward. By default, the Detail section displays first. All users can enter and modify data in both sections, also by default. Administrators can use the DEFAULT_TD_TAB and RESTRICT_TD_TABS dataset parameters to change the section that displays by default and determine whether or not Read/Write users can enter data in the Details section.

•Data entered in the Detail section is translated using the Deferred Entry Set-up default rules and displays in the Rollforward section.

•For information on the Rollforward section, go to the Rollforward page.

All Datasets

•The Activity, Deferred, and Balance Sheet Only column amounts impact the tax provision differently.

•The after tax temporary difference should be entered on a post rate basis. The appropriate federal benefit of state is computed based on these balances.

•To import information to the After Tax Temporary Differences - Tax Basis screen, complete the appropriate fields on the #UATTD# U AfterTx TDs-Tax Basis sheet in the Import Numbers template. For more information on importing, refer to the Importing Templates documentation.

•You can adjust an after tax temporary difference multiple times by making additional entries with different tag letters or different class/subclass combinations.

Import Template

To import information to the After Tax Temporary Differences - Tax Basis page, complete the appropriate fields on the #UATTD# U AfterTx TDs-Tax Basis sheet in the Import Numbers template.

See Data Entry Import for more information about the After Tax Temporary Differences - Tax Basis data import process.

After Tax Temporary Differences - Tax Basis

Data Entry Fields

The grid lets you enter amounts and select options from the drop-down lists. You can use the tab key to move between the fields much like an excel worksheet.

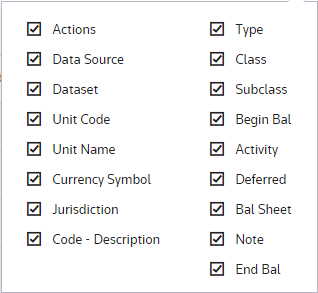

The After Tax Temporary Differences - Tax Basis component grid includes the following columns. See Data Table for more information about the grid options.

Actions

Actions allow you to supplement the adjustment with detail. Double click ![]() to add an attachment.

to add an attachment.

Data source

Data Source enables you to view the Data Source History.

Dataset

The Dataset selected in the Base Dataset drop-down list.

Unit Code

The Unit Code is established by an Administrator for the After Tax Temporary Differences - Tax Basis.

Unit Name

The Unit Name is established by an Administrator for the After Tax Temporary Differences - Tax Basis.

Currency Symbol

The Currency Symbol is established by an Administrator for the After Tax Temporary Differences - Tax Basis.

Jurisdiction

Jurisdiction lets you select the jurisdiction for the adjustment.

Code - Description

The code and description are established by an Administrator for the after tax temporary difference.

Type

There are two types of temporary differences balances - Current and Non-Current. Select the type that best relates to the balance sheet account where the deferred tax asset or liability should be represented.

Tag

The tag letter identifies each line entered in the originating source.

Class

The class identifies each line entered in the originating source.

Subclass

The subclass identifies each line description entered in the originating source. You can select Next Value as the subclass and the application generates the next "Code" number for the selected Code, Type and Class.

Beginning Balance

The cumulative after tax temporary difference balance rolls forward from the prior dataset. The beginning balance can be overridden manually or with an import.

Note: The administrator has the ability to lock beginning balances and the Beginning Bal column does not allow data entry for Read/Write Users.

Activity

•Activity impacts the current and deferred provision, as well as deferred balances.

•Positive amounts increase and negative amounts reduce the taxable income. Amounts should be entered in local currency. They are translated using the unit's weighted average FX rate to the reporting currency.

Deferred

•Deferred impacts the deferred provision, as well as deferred balances.

•Typically this entry type is used for the impact of valuation allowances or adjustments to prior year balances.

Balance Sheet Only

•Balance only impacts deferred balances.

•Typically this entry type is used for the impact of equity or other comprehensive income items.

•The Balance Sheet Only (BSO) adjustment on the Tax Provision report removes the BSO Adjustment from the Deferred Provision.

Note

You can type notes to supplement the adjustment. You can access a history of the Notes within "Data Source History."

Ending Balance

•The component is set up by an administrator as an "Assigned Component Type."

•To enter the ending balance only, select the tax adjustment assigned with the "End Bal" class.

•Type or Import the balance.

Notes:

•A Default Type can be set by the System Administrator and you may not have the ability to select between C -Current and NC -Non-Current.

•The System Administrator may have allowed the ability to deviate from the Default Type and allow you to select between C -Current and NC -Non-Current.

•The Temp Diffs Discrepancy report will be available to review the Temporary Differences - Tax Basis that have been overridden and deviate from the default type set up by the administrator.

•Please contact your administrator if you have questions about the default type set up.