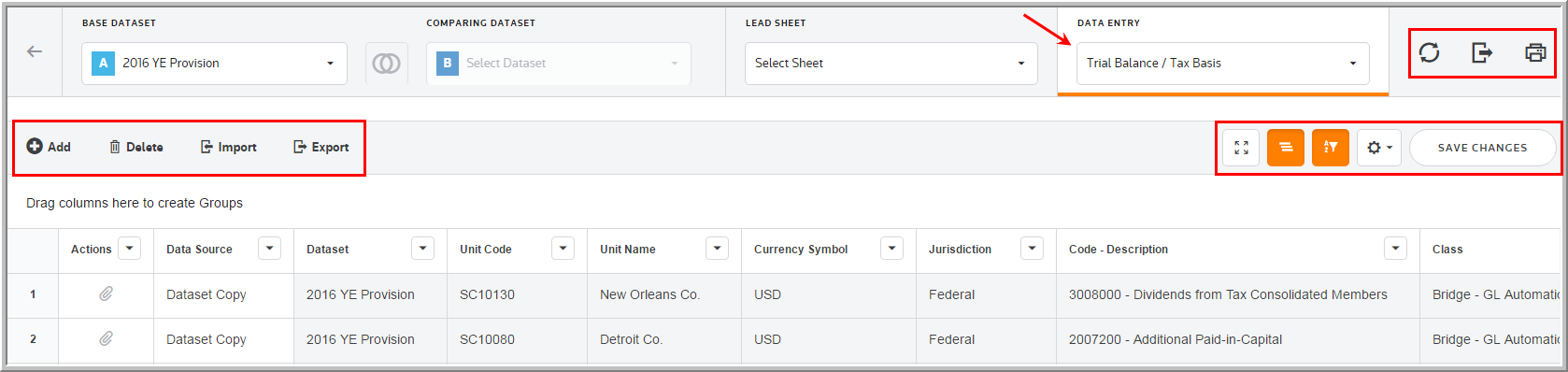

Trial Balance /Tax Basis

In the Data Entry list, you can select the Trial Balance/Tax Basis component to enter federal and jurisdiction data. In the Trial Balance/Tax Basis page, you can refresh, export (informational purposes), print, add, edit, delete, import, export (template), group columns, show/hide columns, and filter your provision and estimated payment data.

This area populates the ending trial balance amounts and allows you to make book adjustments, tax reclasses, and other adjustments. This can ultimately be used as the starting point for the tax basis balance sheet. Typically, the trial balance data is bridged into the system from an extract of the general ledger.

Import Template

To import information to the Trial Balance/Tax Basis page, complete the appropriate fields on the #UTBBS# Unit Tax Basis BalSheet worksheet in the Import Numbers template.

See Data Entry Import for more information about the Trial Balance/Tax Basis data import process.

Trial Balance/Tax Basis

Data Entry Fields

The grid lets you enter amounts and select options from the drop-down lists. You can use the tab key to move between the fields much like an excel worksheet.

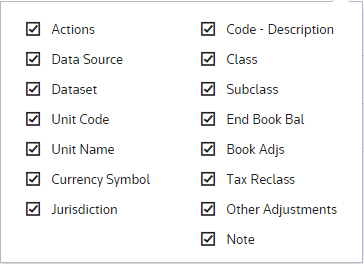

The Trial Balance/Tax Basis component grid includes the following columns. See Data Table for more information about the grid options.

Actions

Actions allow you to supplement the adjustment with detail. Double click ![]() to add an attachment.

to add an attachment.

Data source

Data Source enables you to view the Data Source History.

Dataset

The Dataset selected in the Base Dataset drop-down list.

Unit Code

The Unit Code is established by an Administrator for the Trial Balance/Tax Basis

Unit Name

The Unit Name is established by an Administrator for the Trial Balance/Tax Basis.

Currency Symbol

The Currency Symbol is established by an Administrator for the Trial Balance/Tax Basis.

Jurisdiction

Jurisdiction lets you select the jurisdiction for the adjustment.

Code - Description

The code and description are established by an Administrator for the trial balance sublines.

Tag

The tag letter identifies each line entered in the originating source.

Class

The class identifies each line entered in the originating source.

Subclass

The subclass identifies each line description entered in the originating source. You can select Next Value as the subclass and the application generates the next "Code" number for the selected Code, Type and Class.

Ending Book Balance

Populates the trial balance ending balance data for the period.

Book Adjustments: Book adjustments to the ending balances can be made to generate the adjusted ending balances.

Tax Reclass

Tax reclasses can be made to the adjusted ending balances.

Other Adjustments

Other adjustments can be made to the adjusted ending balances.

Note

You can type notes to supplement the adjustment. You can access a history of the Notes within "Data Source History."