Trial Balance Data

ONESOURCE Tax Provision uses trial balance accounts to calculate a tax basis balance sheet and income statement. You define trial balance accounts by mapping them, then enter balances for those accounts. You enter data by using the bridge import functionality, the numbers import template and manually.

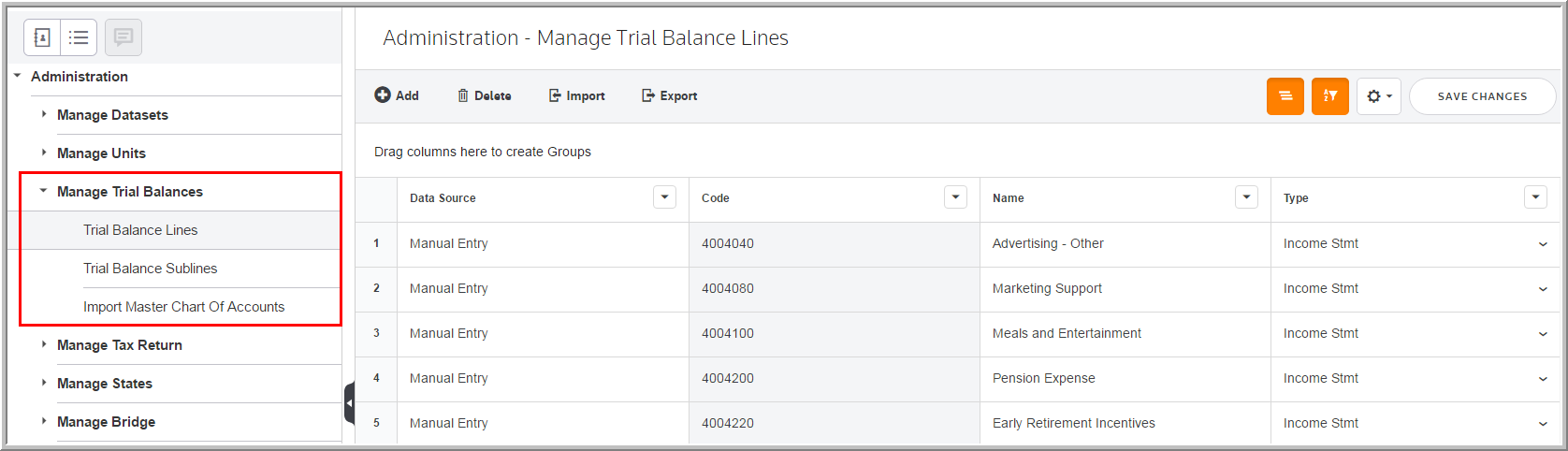

•Use Manage Trial Balance to map accounts in trial balance lines and sublines. This determines the presentation of the accounts.

•Use the Bridge Import functionality to transfer balances in an extract file (from a general ledger).

•Use the Import Numbers template in the Trial Balance/Tax Basis page.

•Use the Import Master Chart of Accounts to populate data using your General Ledger system.

•Populate the book trial balances then make Book Adjustments, Tax Re-class, and Other Adjustments, as needed.

Note: Generally, you populate trial balance accounts in a pre-closed basis and have book adjustments close out Income Statement items in Retained Earnings, and assets equal liabilities plus equity on reports.

Manage Trial Balance