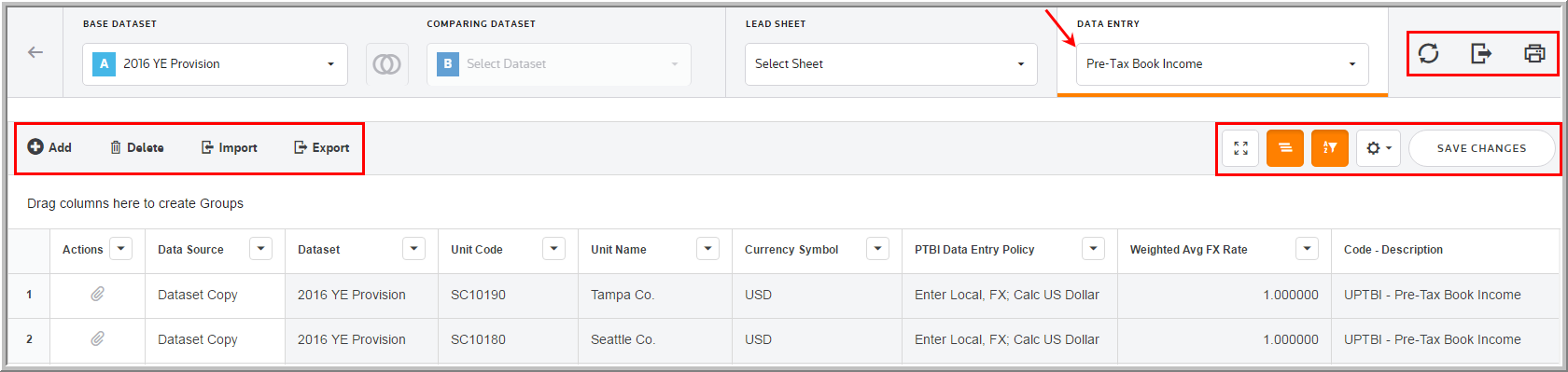

Pre-Tax Book Income

In the Data Entry list, select the Pre-Tax Book Income component to enter your data. In the Pre-Tax Book Income page, you can refresh, export (informational purposes), print, add, edit, delete, import, export (template), group columns, show/hide columns, and filter your Provision, Interim Actual, and Estimated Payment data.

Depending on the Data Policy either the Pre-Tax Book Income (Local) and/or Pre-Tax Book Income (USD) are editable. If the Data Policy selected calculates the balance, then the balance is not editable. Although the field is named Pre-Tax Book Income (USD), this figure also represents Pre-Tax Book Income in Reporting Currency other than the US Dollar.

Pre-Tax Book Income Details

•An administrator will set up the PTBI Data Entry Policy in the Rates page. •An administrator will set up the Wghtd Avg FX Rate in the Rates page. •You can enter Local and Reporting amounts. •When reviewing Pre-Tax Book Income, an income amount is entered as a positive number and a loss amount is entered as a negative number. •For the Wghtd Avg FX Rate, the balance amounts are available for both local and reporting currency. Depending on the PTBI Data Entry Policy, you can edit the Pre-Tax Book Income (Local) or Pre-Tax Book Income (USD). •If you select a PTBI Data Entry Policy that calculates the balance, then you cannot edit the Wghtd Avg FX Rate balance amounts. •Although the field's label is Pre-Tax Book Income (USD), this amount also represents Pre-Tax Book Income in reporting currency other than the US Dollar. |

|---|

Import Template

To import information in the Pre-Tax Book Income page, complete the appropriate fields on the #PTBI# PTBI worksheet in the Import Numbers template.

See Data Entry Import for more information about the PTBI data import process.

Pre-Tax Book Income

Data Entry Fields

The grid lets you enter amounts and select options from the drop-down lists. You can use the tab key to move between the fields much like an excel worksheet.

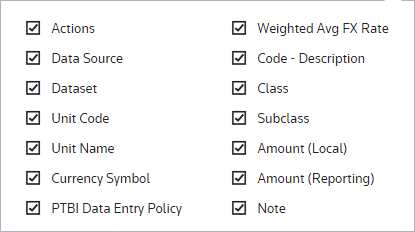

The Pre-Tax Book Income component grid includes the following columns. See Data Table for more information about the grid options.

Actions

Actions enable you to attach documents and supplement detail for an adjustment. To Manage Attachments double click ![]() to add an attachment.

to add an attachment.

Data source

Data Source enables you to view the Data Source History.

Dataset

The Dataset selected in the Base Dataset drop-down list.

Unit Code

The Unit Code is established by an Administrator for the Pre-Tax Book Income.

Unit Name

The Unit Name is established by an Administrator for the Pre-Tax Book Income.

Currency Symbol

The Currency Symbol is established by an Administrator for the Pre-Tax Book Income.

PTBI dATA eNTRY pOLICY

The PTBI Data Entry Policy is established by an Administrator for the Pre-Tax Book Income.

wEIGHTED aVG fX rATE

The Weighted Avg FX Rate is established by an Administrator for the Pre-Tax Book Income.

Code - Description

The code and description are established by an Administrator for the Pre-Tax Book Income.

Tag

The tag letter identifies each line entered in the originating source. The Tag column only appears in Tag Datasets.

Class

The class identifies each line entered in the originating source. The list of Classes are created and assigned in "Administration."

Subclass

The subclass identifies each line entered in the originating source. The list of Subclasses are created and assigned in "Administration."

Amount (Local)

Type the Local balance.

Amount (Reporting)

Type the Reporting balance.

Note

You can type notes to supplement the adjustment. You can access a history of the Notes within "Data Source History."