Net Deferred Tax Asset/Liability

Reporting Levels: |

|||||||

Unit |

|

Sub-consolidation |

Consolidation |

||||

Reporting Configurable Options: |

|||||||

Dataset |

Unit |

|

Sub-consolidation |

Currency |

|||

Source Data: |

|||||||

Unit Details, Temporary Differences, After Tax Temporary Differences, NOL Temporary Differences, State After Apportionment Temporary Differences, State After Tax Temporary Differences |

|||||||

Available Views: |

|||||||

Custom Rollups Federal / State / FBOS / Fed+State+FBOS / state/fed+FBOS Summary / Detail / Hybrid Total / By Country |

|||||||

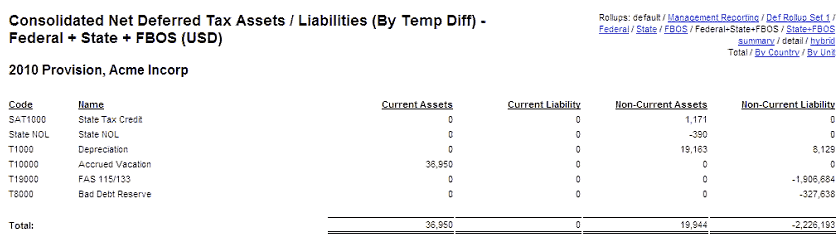

The Net Deferred Tax Assets/Liabilities report for Provision and Interim datasets nets temporary and NOL differences by jurisdiction and displays ending deferred balances in their current and non-current designations. The report considers current and non-current balances separately. It then nets all units with a common country designation from the Administration area in Manage Units folder > Units. If there is more than one Jurisdiction netting concept in a country, you can create another country in the Administration area in System > Manage Countries/Currencies (e.g., if there are two UK netting groups, you could have two countries: UK1 and UK2). The Temporary Differences Summary report lists current assets and liabilities, as well as non-current assets and liabilities.

Note:

•In order for the Net Deferred Tax Assets/Liabilities report to display at the Sub-consolidated level, all entities associated with each country represented in the sub-consolidation must be included. If they are not included, you will receive a message “Unit does not consist of complete country, cannot display report” error message.

Provision Items

•Deferred Tax Asset/Liability

Report Views

•Defaults to the Default, Federal + State, Detail, and Total views.

•Rollups are user-defined groupings that allow detail level component data to be consolidated and rolled up to a higher level. Creating and managing rollups for the report occurs in the Administration area. For example, one Rollup may assist in generating the footnote, while another may explain the results for management reporting.

•The Federal, State, FBOS, Fed+State+FBOS, and State/Fed+FBOS options determine the rates that should be applied to temporary differences. Either the default unit rates or the rates that were entered to override the unit rate for a specific line item are applied. The State+FBOS or the Fed+FBOS option displays, depending on the Federal Benefit of State dataset parameter that is selected.

•The Summary, Hybrid and Detail options display either rate effected or pre-tax balances with various levels of detail. For the Summary view, select a rollup code, then click Summary. The Hybrid view displays rollup sub-totals and the underlying detail for each rollup code. The Detail view shows the report at a detailed level. The Unit view group balances into a single line for each unit in the sub-consolidation or consolidation.

•The Total, By Country, and By Unit options determine the level of unit detail that displays. Total displays four columns, By Country displays balances sub-totalled by the country used for jurisdiction netting, and By Unit displays country balances by underlying units.

Line by Line

•Temporary Differences: Data Entry > Temporary Differences - Tax Basis, Temporary Differences - Book/Tax Basis, State Temporary Differences - Tax Basis, and State After Apportionment Temporary Differences - Tax Basis in a Provision dataset.

•NOL Reclass: Data Entry > NOL Temporary Differences - Tax Basis in a Provision dataset.

•After Tax Temporary Differences: Data Entry > After Tax Temporary Differences - Tax Basis, After Tax Temporary Differences - Book/Tax Basis, and State After Tax Temporary Differences - Tax Basis in a Provision dataset.

Column by Column

•Temporary differences are netted on a jurisdiction basis by looking to the unit's country code designation to arrive at the asset or liability determination. The Temporary Differences Summary report considers only temporary differences entered for each unit when netting. The Temporary Differences Summary (Fed Filing Group) report nets balances across units in a filing group.

•Current Assets: Temporary differences identified as C (current) that, after tax rate, have an asset balance when summed with all activity for units with the same country designation.

•Current Liabilities: Temporary differences identified as C (current) that, after tax rate, have a liability balance when summed with all activity for units with the same country designation.

•Non-Current Assets: Temporary differences identified as NC (non-current) that, after tax rate, have an asset balance when summed with all activity for units with the same country designation.

•Non-Current Liabilities: Temporary differences identified as NC (non-current) that, after tax rate, have a liability balance when summed with all activity for units with the same country designation.

Note:

•If you are using a code starting with VA_, you can activate a parameter to enable VA contra accounts for the Net Deferred Balance Report to disregard the net deferred by country logic and present as an asset.

•To activate the parameter, select Administration > Manage Configurations > Reporting > Other > Enable VA Contra Accounts and select Yes for the Net Deferred Report which shows the valuation allowances as Non-Contra accounts.