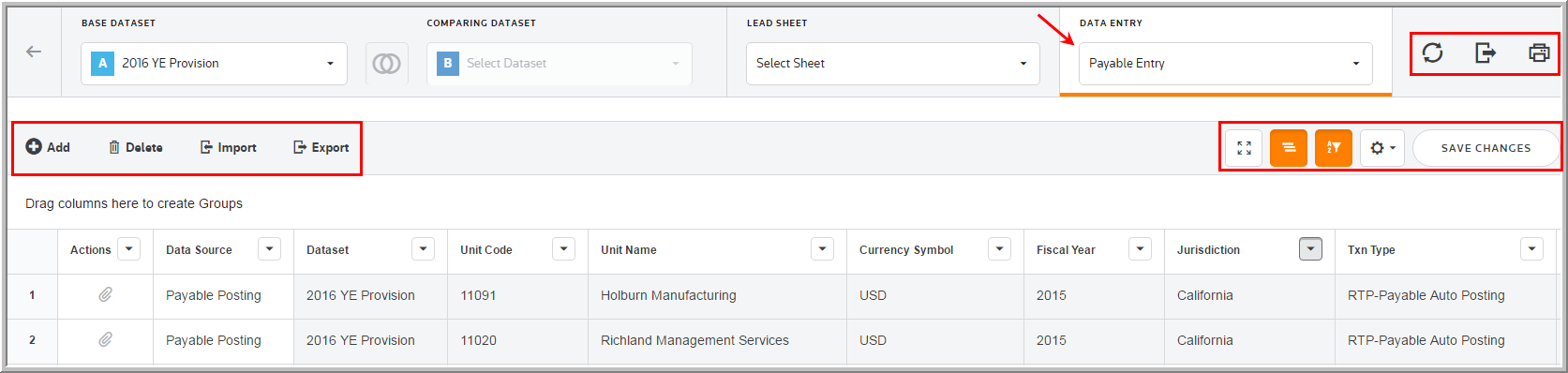

State Payable Entry

In the Data Entry list, you can select the State Payable Entry component to enter federal and jurisdiction data. In the State Payable Entry page, you can refresh, export (informational purposes), print, add, edit, delete, import, export (template), group columns, show/hide columns, and filter your provision and estimated payment data. You will select Receiving or Paying to create a permanent difference in the unit.

•To maximize the payable functionality ensure that the payable set-up is done to reflect the activity in the taxes payable account.

•The payable functionality is activated with a system parameter in Administration > System > Manage Configurations > Advanced Functionality with the Payable Functionality (Recommended), and select Yes.

•Automatic posting from the calculated provision to the payable can be activated with a dataset parameter.

Import Template

To import information to the State Payable Entry screen, complete the appropriate fields on the #SL# State Liability Txns sheet in the Import Numbers template.

See Data Entry Import for more information about the State Payable Entry data import process.

State Payable Entry

Data Entry Fields

The grid lets you enter amounts and select options from the drop-down lists. You can use the tab key to move between the fields much like an excel worksheet.

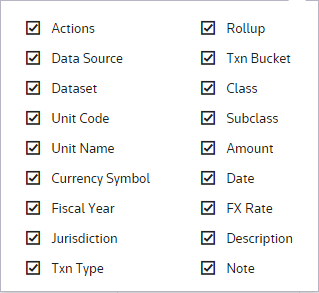

The State Payable Entry component grid includes the following columns. See Data Table for more information about the grid options.

Actions

Actions allow you to supplement the adjustment with detail. Double click ![]() to add an attachment.

to add an attachment.

Data source

Data Source enables you to view the Data Source History.

Dataset

The Dataset selected in the Base Dataset drop-down list.

Unit Code

The Unit Code is established by an Administrator for the State Payable Entry.

Unit Name

The Unit Name is established by an Administrator for the State Payable Entry.

Currency Symbol

The Currency Symbol is established by an Administrator for the State Payable Entry.

Fiscal Year

The fiscal year should be the year to which the payable entry relates.

Jurisdiction

The jurisdiction defaults to FED when data is entered at the unit level.

Txn Type

The options that display are established by an Administrator for transaction types.

Rollup

You cannot select a rollup the column is provided for viewing purposes. The "Rollup" is defined in "Administration" to allow the roll up of user-defined lines.

Txn Bucket

The options that display are established by an Administrator for transaction buckets.

Tag

The tag letter identifies each line entered in the originating source.

Class

The class identifies each line entered in the originating source.

Subclass

The subclass identifies each line description entered in the originating source. You can select Next Value as the subclass and the application generates the next "Code" number for the selected Code, Type and Class.

Amount

Negative amounts increase and positive amounts reduce the taxable payable account. Amounts should be entered in local currency.

Date

The dates are limited to the dates within the dataset year.

•To select dates outside the dataset year, you can activate the system parameter to remove the single year restriction.

1.Select Administration and then System.

2.Click Manage Configurations and then click Yes for "Adjust Payable Date Range."

FX Rate

The weighted average rate on the date of the entry can be entered.

Description

A description is required for each entry. If you do not enter a description, a message appears "Please check your entries for accuracy."

Note

You can type notes to supplement the adjustment. You can access a history of the Notes within "Data Source History."

Note: The administrator has the ability to lock beginning balances and the Beginning Bal column does not allow data entry for Read/Write Users.