Leadsheets

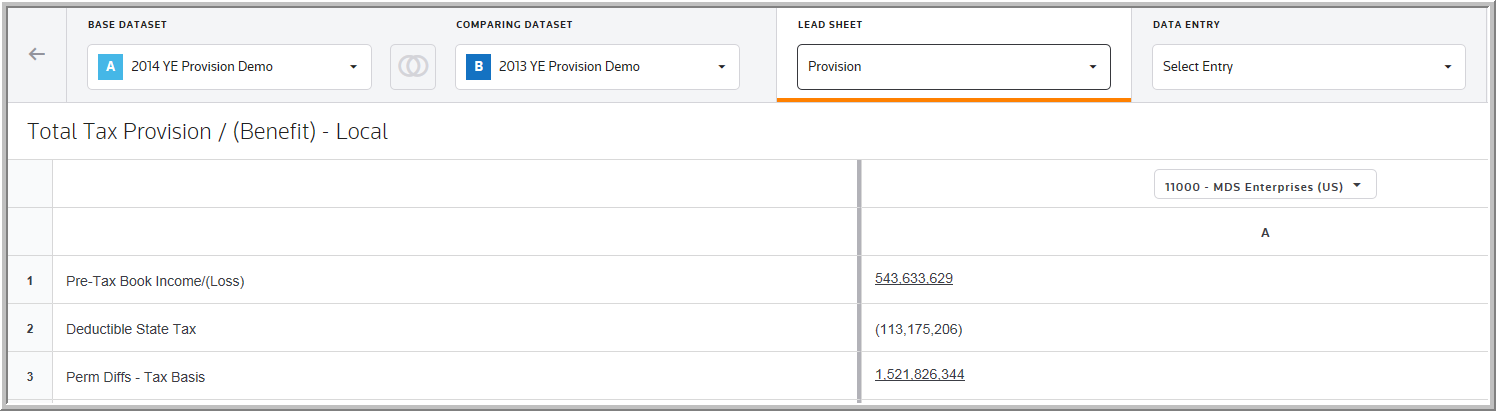

In Review & Edit, you can use Lead Sheets to review your balances for Total Tax Provision (Benefit), Deferred Tax Asset ( Liability) or (Payable) Receivable. There are three different Lead Sheets: Provision, Deferred, and Payable. In the Lead Sheet grid, you can review the line item name and it's value.

To review the Lead Sheet data for your Units and Sub-Consolidations.

1.Select a Base Dataset to see all Units and Sub-Consolidations that are active for that dataset.

2.Select a Lead Sheet from the drop-down list.

•Click ![]() to change between the Reporting and Local currency.

to change between the Reporting and Local currency.

Lead Sheet - Provision

•You can export the Leadsheet to create a pre-defined pivot table that includes the Code, Class & Subclass.

•The navigation bar options let you refresh, export, and print data in the grid.

•The grid controls let you view and select a different unit or sub-consolidation. Here you can open Manage Units to see all of the units for the selected dataset.

See Data Table for more information about the data navigation bar and grid options.

Note: There is not a Lead Sheet for Effective Tax Rate as the ETR value is derived from the provision lead sheet.

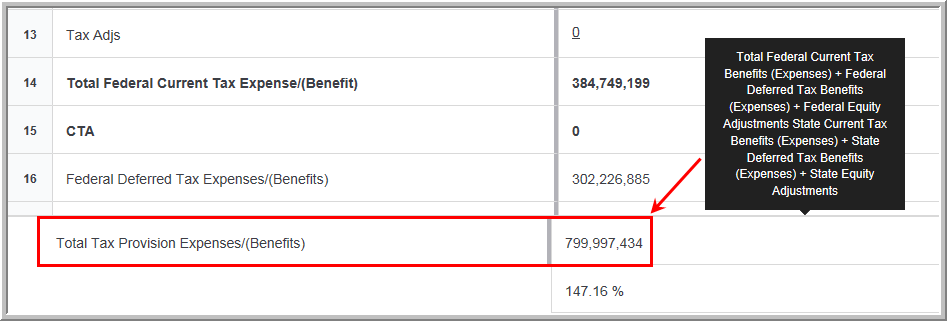

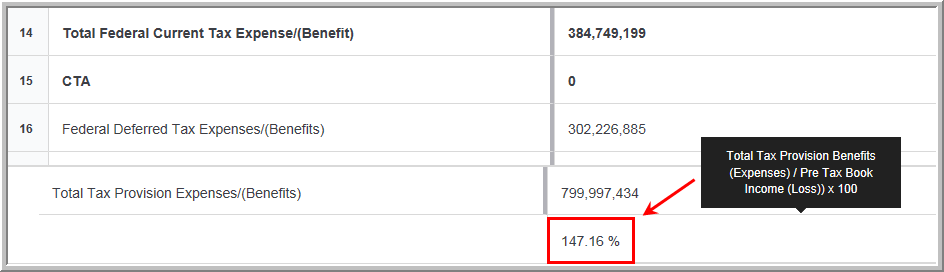

Provision Lead Sheet

The provision Lead Sheet data provides information showing you how the Summary value was calculated in the system.

•When you pause on the Total Tax Provision Expense, the definition appears showing you the calculation.

•When you pause on the Effective Tax Rate, the definition appears showing you the calculation.

Deferred Lead Sheet

The Deferred Lead Sheet shows a summary of deferred's for the Federal + State + FBOS. In the unit's column, you can review the Tax Effected values for the deferred entries.

Payable

The Payable Lead Sheet shows a summary of Payables. The Payables Leadsheet requires some configuration. The activity uses the Txn Types (CPROV - Payable Auto Posting) set up for the payable. The system determines the BBAL- Beginning Balance, Ending Balance, and CTA balance.