Actual

Calculating the Interim Provision for the Quarter

•Populate the Actual with the Actual Pre-Tax Book Income that was generated for the quarter.

•Populate the Statutory Tax Rates in effect during the quarter for each unit. For state, be sure to include the expected apportionment factors for states/jurisdictions.

•Populate the Extraordinary and Discrete Items that arose during the quarter in the appropriate section.

•True-up (if necessary) for the impact of a change in the forecasted annual effective tax rate on prior quarters' Pre-Tax Book Income.

•Activity should be reflected in either the Payable or the APIC Pool balances for the quarter.

•Populate the dataset by entering amounts directly in the system or by using the Import Numbers template.

Interim Provision / Interim Effective Tax Rate

•The system calculates the interim effective tax rate two ways:

o(0) Uses total pre-tax book income that does not include the pre-tax book income of Exclude Foreign Loss and Exclude Unit units.

o(1) Uses pre-tax book income that includes the pre-tax book income of all units, regardless of whether it is an Exclude Foreign Loss or Exclude Unit unit.

•Use the dataset parameter, USE_WWPTBI_INTPROVETR with a parameter value of 0 or 1, to determine how the system calculates the interim effective tax.

•Although the tax effect of pre-tax book income at forecast rates of Exclude Foreign Loss and Exclude Unit units may not be included, the tax effect of its discrete items are included in the interim provision.

Applying the Annualized Forecasted Effective Tax Rate versus Unit Rates

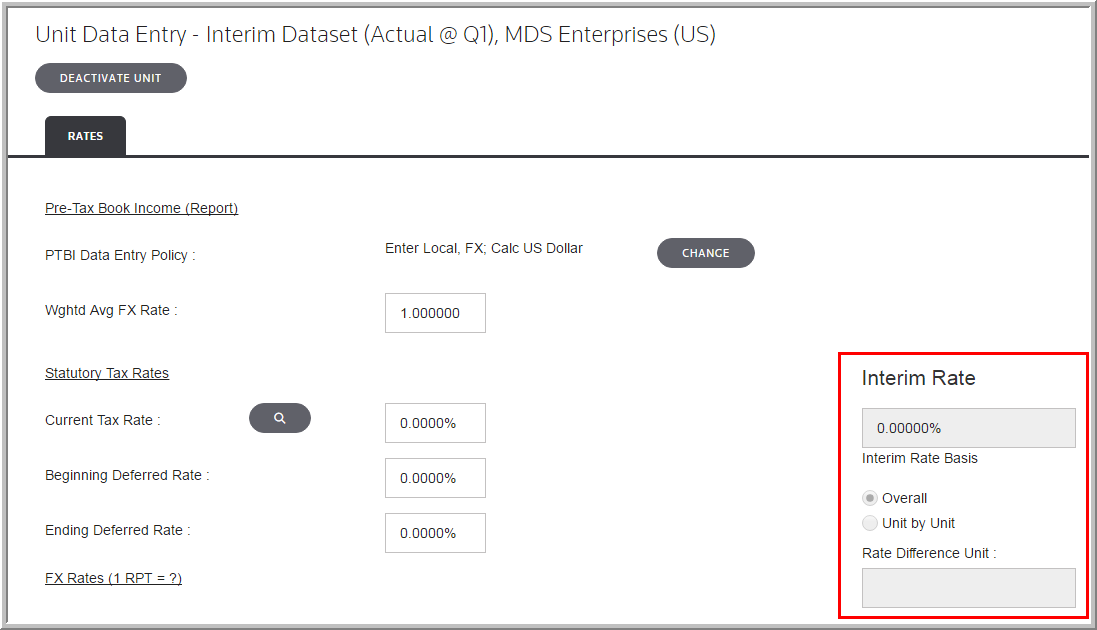

•The system uses the Annualized Forecasted Effective Tax Rate to compute the current tax on the Pre-Tax Book Income based on either a unit-by-unit basis or on an overall basis, depending on the option you select for the dataset.

•The system uses Unit Rates to compute the current, deferred taxes, and equity impact on the Extraordinary and Discrete Items for the quarter.

Reviewing the Interim Provision Results

•The Interim Provision report shows the Current, Deferred, and Equity provision calculations. The system applies the Forecast rate to the Pre-Tax Book Income,then adds that amount to the Extraordinary/Discrete items at the unit rates to arrive at the provision for the quarter. Also, there is a state level Interim Provision report.

•The Effective Tax Rate Reconciliation report shows the components of the interim provision. Although, similar to the report in a Provision dataset, the Interim report has an additional line that reconciles the Forecast versuss Actual rate impact on Pre-Tax Book Income.

•The Deferred Balances, Temporary Difference Summary, Foreign/Domestic Summary, Payable, and Journal Entry reports are identical to the reports in the Provision dataset. They display the data for the interim period.