Forecast

Calculating the Annualized Forecast Effective Tax Rate

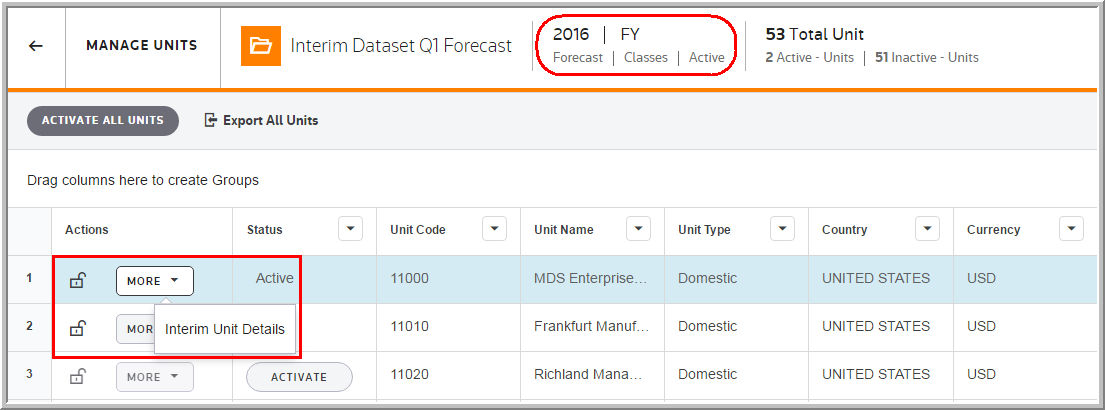

My Datasets > Forecast Unit > More > Interim Unit Details

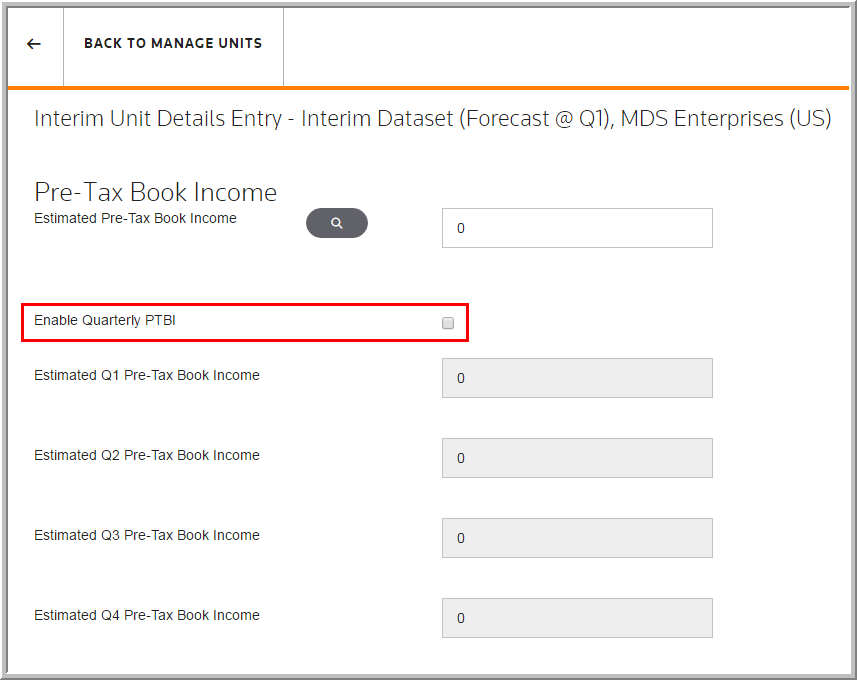

Interim Unit Details

•Enter the Forecast Pre-Tax Book Income expected for the year. You can track by a quarter or on an annual basis.

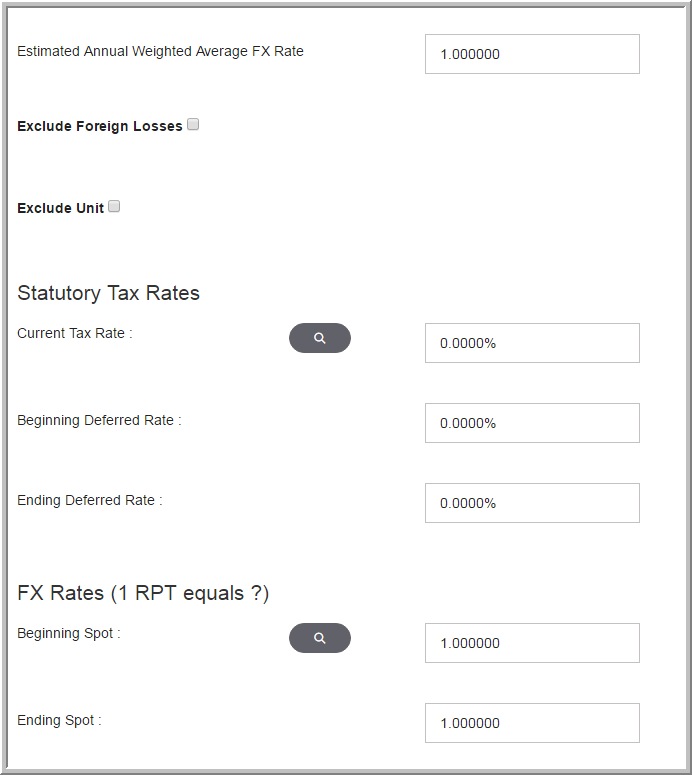

•For each unit, enter the Statutory Tax Rates expected to be enacted by the end of the year.

•For a state, you must include the expected apportionment factors for states/jurisdictions.

You can exclude Units from the forecast rate calculation. Exclude a unit, on a unit-by-unit basis, when the unit has a loss or when the unit has either income or a loss.

Interim Dataset Rates

•Enter Permanent Differences, Temporary Differences - Tax Basis, After Tax Temporary Differences - Tax Basis, Tax Adjustments, NOL Temporary Differences - Tax Basis, InterCompany Transaction Entry and State data.

•Enter all known Annualized Book/Tax Differences expected to impact the effective tax rate (for example, permanent differences, tax adjustments, and temporary differences with deferred only activity).

•Manually enter amounts or import them using the Spreadsheet Import Numbers Template.

Determining the Basis that the Annualized Forecast Effective Tax Rate should be Applied

There are several ways to interpret the guidance for Interim reporting. Depending on your interpretation, you can present the Forecast Effective Tax Rate on an overall or unit-by-unit basis. You select the interim rate basis when creating an interim dataset.

Reviewing the Annualized Forecast Effective Tax Rate

Use the Forecast Rate report tor review the results of your data entry. The report has several views to understand better how the system generates the rate.