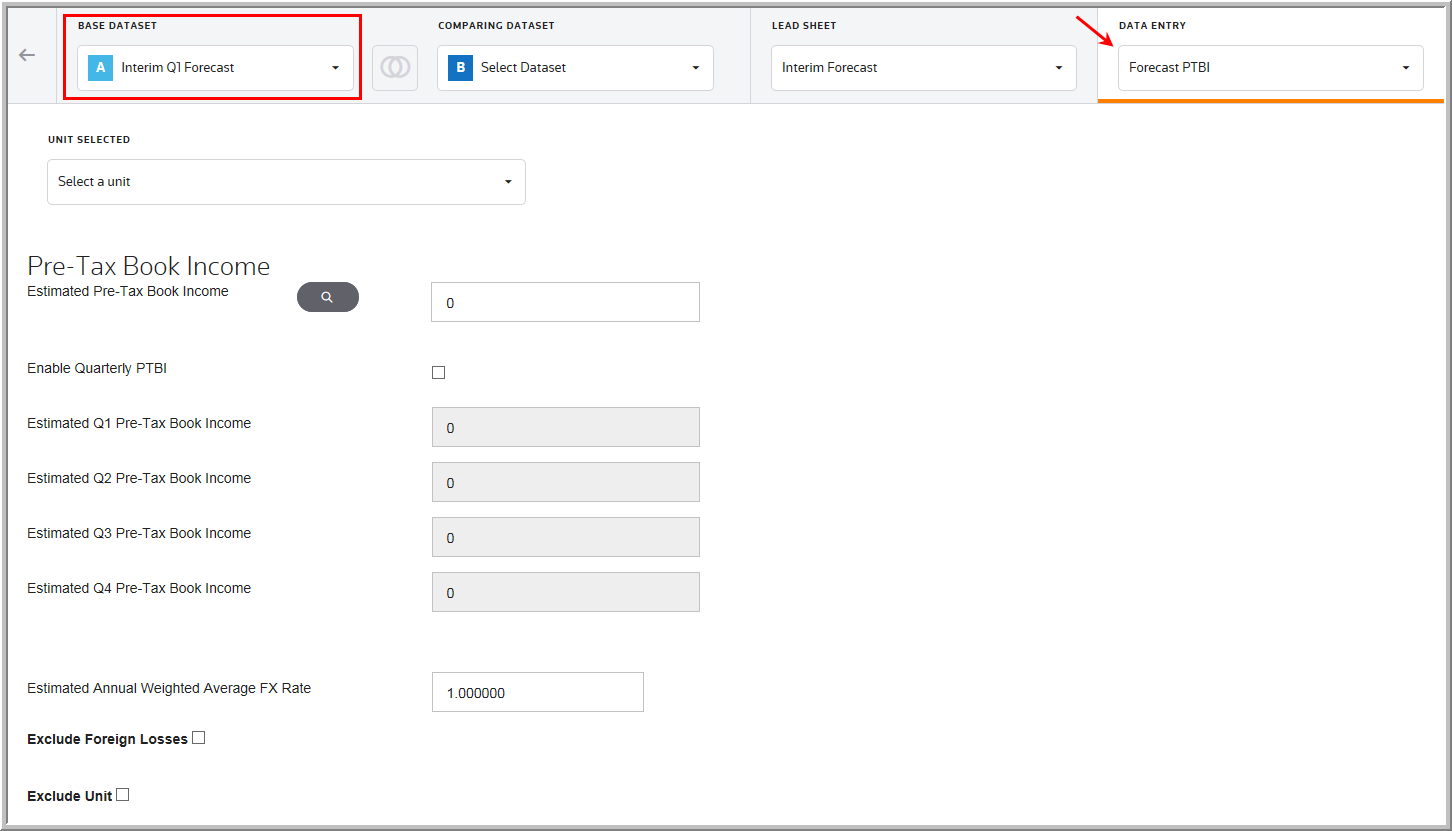

Forecast PTBI

In the Data Entry list, you can select the Forecast Pre-Tax Book Income component to enter your data. In the Forecast Pre-Tax Book Income page, you can select a unit, and enter your estimated Pre-Tax Book Income. Estimated Annual Weighted Average FX Rate, Statutory Tax Rates, and FX rates fields are read-only. To edit these values go to the Interim Unit Details page under the More dropdown in Manage Units (My Datasets).

Import Template

To import information to this page, complete the appropriate fields on the #FORU# Forecast Unit worksheet in the Import Numbers template.

Note: If you select Provision, Estimated Payments or Interim Actual datasets, you will not see Forecast Pre-Tax Book Income in the components list.

Pre-Tax Book Income - Estimated Pre-Tax Book Income

Pre-Tax Book Income should be entered in local currency. Estimated Pre-Tax Book Income can either be entered as an annualized amount or in amounts for the four quarters that make up the annual amount when Enable Quarterly PTBI is selected.

Note: When Enable Quarterly PTBI is selected, Instead of adding rounding excess to the fourth quarter, each quarter now shows its own rounding. Check the rounding when the annual amount is not evenly divisible by four.

Estimated Annual Weighted Average FX Rate

The specified Weighted Average Foreign Exchange rate for the unit for the period covered by the dataset. Enter the rate using the ratio of what 1 unit of the reporting currency would equal in the local currency. The Weighted Average Foreign Exchange rate is used to convert entries for the unit that have an Income Statement provision impact. Enter 1 if the local and reporting currency are the same.

Exclude Unit Designation

•Exclude Foreign Loss: The system excludes the unit from the interim provision calculations if the Forecast Federal Taxable Income is a negative amount. If the amount is positive, the unit is included in the calculation.

•Exclude Unit: The system excludes the unit from the interim provision calculations.

•The dataset parameter USE_WWPTBI_INTPROVETR determines how Exclude Foreign Loss or Exclude Unit will affect the interim provision calculations. The dataset parameter has a value of 0 or 1.

oWhen the parameter value is equal to 0: The interim provision and effective tax rate calculations will not include the Pre-tax book income of Exclude Foreign Loss or Exclude Unit units.

oWhen the parameter value is equal to 1: The interim provision and effective tax rate calculations will include the Pre-tax book income of Exclude Foreign Loss or Exclude Unit units.

Note: The interim reports are indicated with an asterisk and footnote in a report, if the unit is an Excluded Foreign Loss or Excluded Unit unit (for example, Exclude Unit or Exclude Foreign Loss).

Unit Tax Rates

•The current and deferred tax rates for the specified unit are used for all unit specific reports. They are also taken into account for Federal Benefit of State (FBOS) calculations when working with state data.

•If the Beginning and Ending Deferred Tax rates differ for a unit, the system automatically calculates any necessary change in rate adjustment on beginning temporary difference balances. Support for the calculated adjustment displays in the deferred balances report as a separate column.

•If the Current Tax rate and the Ending Deferred Tax rate differ for the unit, the system automatically calculates the necessary impact of the rate difference for activity entered for temporary differences. The impact of the rate difference can be viewed in the Effective Tax Rate report.

Deferred FX Rates

In the Beginning and Ending fields, enter the specific Beginning and Ending Spot rates for the unit for the period covered by the dataset. Enter the rate using the ratio of what 1 unit of the reporting currency would equal in the local currency. The Beginning and Ending Spot rate is used to convert entries for the unit that have a Balance Sheet provision impact. Enter 1 if the local and reporting currency are the same.

Deferred Provision Only Adjustment

•The adjustment to the deferred tax provision expense is a separate line item on the tax provision report. It impacts the Effective Tax rate. The deferred expense amount does not have a related deferred tax asset or liability associated with it.

•Be sure to use this field appropriately, because additional support may be required to justify the expense on the provision.

For the Forecast Pre-Tax Book Income, you can enter data in the following fields: |

For Forecast Pre-Tax Book Income, the following fields are read only. To change these fields you must do so in the Unit Details page. |

|---|---|

•Estimated Pre-Tax Book Income •Estimated Q1 Pre-Tax Book Income •Estimated Q2 Pre-Tax Book Income •Estimated Q3 Pre-Tax Book Income •Estimated Q4 Pre-Tax Book Income |

•PTBI Data Entry Policy (Read only) •Weighted Avg FX Rate columns (Read only) •Estimated Annual Weighted Average FX Rate •Statutory Tax Rates •FX Rates (Deferred FX Rates) •Exclude Foreign Losses •Exclude Unit •Deferred Provision Adjustment Only |

Forecast Pre-Tax Book Income