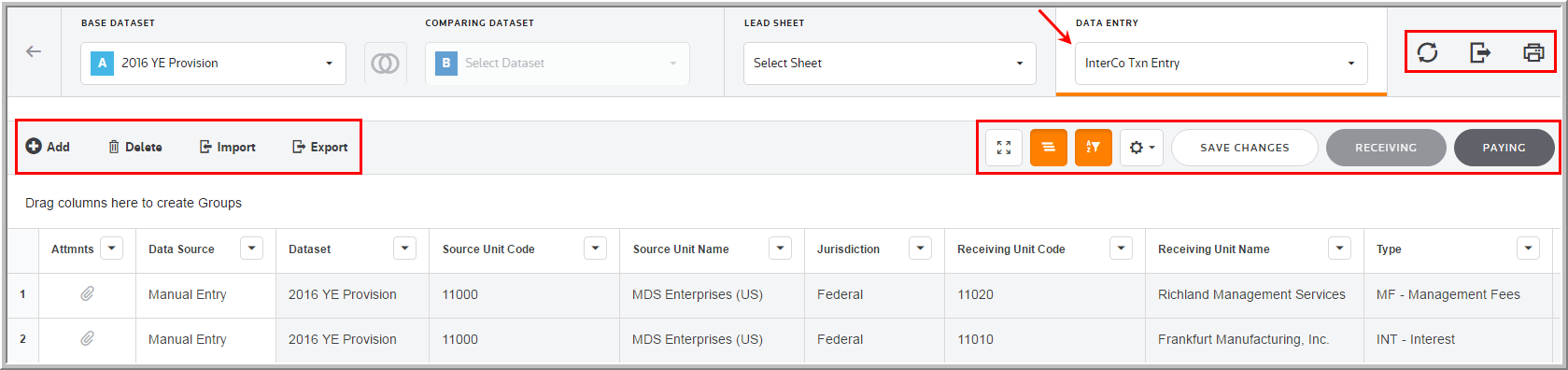

Intercompany Transaction Entry

In the Data Entry list, you can select the InterCompany Transaction component to enter federal and jurisdiction data. In the InterCompany Transaction page, you can refresh, export (informational purposes), print, add, edit, delete, import, export (template), show/hide columns, and filter your provision and estimated payment data. You will select Receiving or Paying to create a permanent difference in the unit.

Transactions among units can be set up to account for the movement of tax amounts and the impact of the associated withholding tax treatment on transactions. Entries can be entry on either the paying or receiving unit and are posted as a permanent difference on the units.

Import Template

To import information to the InterCompany Transaction Entry page, complete the appropriate fields on the #ICOTXNS# Inter Co Txns sheet in the Import Numbers template.

See Data Entry Import for more information about the InterCompany Transaction data import process.

InterCompany Transaction

Data Entry Fields

The grid lets you enter amounts and select options from the drop-down lists. You can use the tab key to move between the fields much like an excel worksheet.

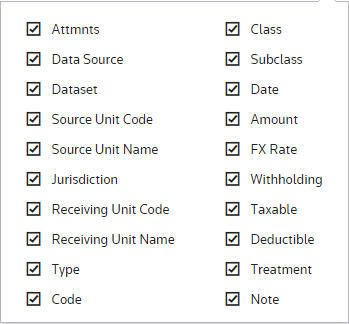

The InterCompany Transaction component grid includes the following columns. See Data Table for more information about the grid options.

Attmnts

Actions allow you to supplement the adjustment with detail. Double click ![]() to add an attachment.

to add an attachment.

Data source

Data Source enables you to view the Data Source History.

Dataset

The Dataset selected in the Base Dataset drop-down list.

Source Unit Code

The Unit Code is established by an Administrator for the InterCompany Transaction.

source Unit Name

The Unit Name is established by an Administrator for the InterCompany Transaction.

Jurisdiction

Jurisdiction lets you select the jurisdiction for the adjustment.

Paying/Receiving Unit

There can be intercompany transactions between any two units.

Type

The options that display are established by an Administrator for transaction types.

Code

The transaction code is user-defined.

Tag

The tag letter identifies each line entered in the originating source.

Class

The class identifies each line entered in the originating source.

Subclass

The subclass identifies each line description entered in the originating source. You can select Next Value as the subclass and the application generates the next "Code" number for the selected Code, Type and Class.

Date

The date of the transaction.

Amount

The transaction amount for the intercompany transaction.

FX Rate (Paying Unit to Receiving Unit)

The weighted average rate that the paying unit uses to pay the receiving unit.

Withholding Tax Receiving Unit

Percentage of the transaction amount that is withheld for the receiving unit.

Taxable at Receiving Unit

Designate if the transaction amount is taxable by the receiving unit. It is posted as a permanent difference.

Deductible at Paying Unit

Designate if the transaction amount is deductible by the paying unit. It is posted as an offset permanent difference. Withholding Tax Treatment: Designate if the withholding is D for Deductible, C for Creditable, or N for Neither.

Treatment

Select if the transaction amount is Deductible or Creditable.

Note

You can type notes to supplement the adjustment. You can access a history of the Notes within "Data Source History."