rtp Posting

Dataset Relations lets you automatically update the Tax Provision through the calculation and posting of RTP true-ups. For the system to post RTP adjustments, you must relate a dataset with Tax Return data (holds the filed tax return data) to the same or previous period dataset with Provision data (final provision), and a same or future period Target dataset (current year tax provision).

You activate RTP adjustments from the Return dataset. The Return dataset is a PROV (Provision Dataset) loaded with Tax Return data. The system posts True-ups to the current year Tax Provision (target dataset) using Non-Cash Tax Adjustments (for the current) and Deferred Only adjustments (for the Deferred). Through the use of parameters, the system also allows you to post multiple RTP adjustments to a single RTP Target dataset.

Important:

•This feature is only available for the PROV (Provision Dataset).

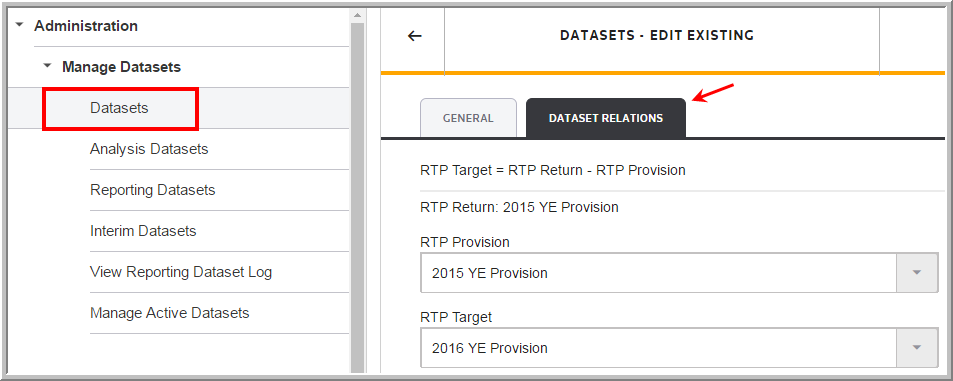

•Create new dataset relations by selecting Administration > Manage Datasets > Datasets > Add. Complete the data entry and set up the Dataset Relations.

•View and update dataset relations by selecting Administration > Manage Datasets > Datasets. Select a dataset (one loaded with return data), click the Edit icon and set up the Dataset Relations.

Dataset Relations

See Importing Categories and Spreadsheet Import for more information about that functionality.