Configurable Journal Entry

You can configure the Journal entry report to an expanded version. The system lets you combine each of the provision calculations in the system, and data in either the taxes per book fields or trial balance lines, to create a journal entry report. You need to add several parameters to use the configurable JE functionality. The Journal Entries page lets you configure how calculations and other data appear in the Output Journal Entries reports.

The Configurable JE module provides a flexible mechanism for generating tax Journal Entries. You must consider several factors when configuring this module.

For further assistance, contact either your Client Manager or the Tax Provision support team.

License

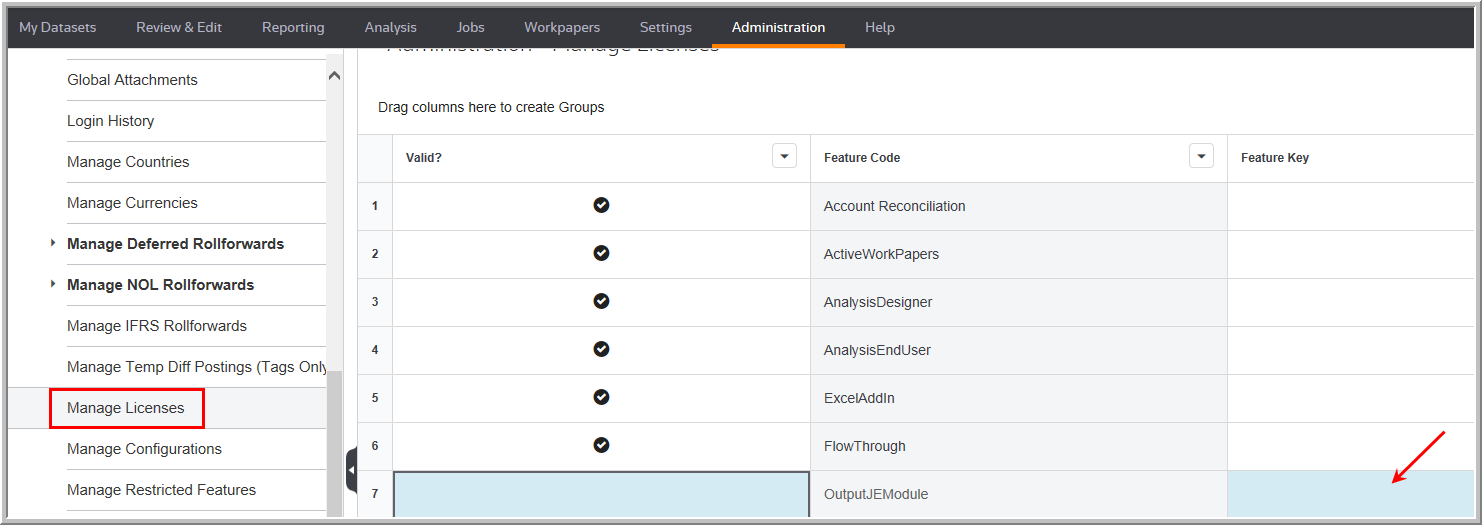

You must have an appropriate License Code and License Key to view Configurable JE reports. Administrators enter this information by selecting the Administration > System > Manage Licenses.

Note: Hosted clients cannot enter the license information and must contact the Tax Provision Technical Support team to get the license assigned to their account.

Manage Licenses

Configuration Options

Level of Data

You can set up the lines of the Journal Entry to show the results as a summary or with details. The level for a company’s tax accounts determines the number of required lines. Some require, even when all tax account balances go to one account, you must enter the components of the journal entry at the data entry level.

Types of Data

You can configure the various components of the provision:

•The standard current and deferred tax impact of the provision.

•The impact of Equity items on an income statement and balance sheet.

•Other items that occur, such as the impact of RTP and uncertain tax positions.

•The impact of an amount provided from a previous quarter in the payable or deferred tax asset/liability unit-by-unit.

•Set up Units at a granular level. Book units within a filing group on the parent or on the unit. Calculate Journal entries for both.

•Mappings are for Federal amounts or State amounts.

Configure Unit by Unit

•You can set up some units at a granular level and others at a topside level.

•Units that are part of a filing group can be booked on the parent or unit – Journal Entries will be calculated for both.

Federal/State/Foreign

•All mappings can be done for the federal / state / foreign amounts.

Unit Configuration

Determine the journal entry configuration on a unit-by-unit basis in My Datasets > Units > More > Journal Entries.

After configuring each unit's JE, you can import data for all units using the Import Numbers template with the following worksheets: #JES# Journal Entries, #JETAX# JE Tax Calcs, and #JEGL# JE GL Calcs.

Reports

•You can view Journal Entry reports for a single unit, filing group, sub-consolidated, or consolidated basis (if the local currency is the same). Select Reporting > Journal Entry > Output Journal Entries. You can assign up to 99 custom reports for Output Journal Entries.

•All users can view JE reports.

•Amounts appear in a Credit Debit format.

•Unlike most reports, this functionality is not self-reconciling. There are no system checks. Make sure you have configured the Journal Entry, correctly. Reports will show Journal Entry does not net to zero.

Note: The Configurable Journal Entry module provides a flexible mechanism for generating tax Journal Entries. There are some factors to consider when configuring this module.

For further assistance, contact either your Client Manager or the support department.

The report has a flexible approach for the book and tax accounts as well as the format.

•Each journal line is configured separately.

oYou can create one or more lines for a debit/credit balance.

•You can configure and maintain the data, once set up.

•Use to review the granular components of Tax Provision Calculation.

•Allows for summation by GL Account.

•Breaks out Federal and State (all, individual or groups) calculations.

•Provides Journal Entries by Unit and Filing Group.

Note: You activate the Configurable JE report by selecting Administration > System > Manage Configurations > Advanced Functionality > Journal Entries > Enable Configurable Journal Entry.