Automation

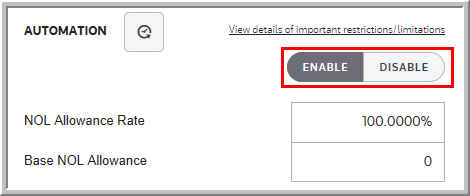

You can manage the NOL Automation information for Provision and Estimated Payments datasets in the Automation section of the Activated Jurisdictions page. You will select Enable to open the NOL fields to enter data.

To enter NOL Allowance Rate and Base NOL Allowance data select My Datasets > Units > Jurisdictions > Activated Jurisdictions > Edit > Automation.

•Type the percentage and amount.

NOL Automation

•The automation posts an amount as a NOL Temporary Difference with the system code NOL_SYS and the tag of A. The NOL automation posts a reclass that creates the NOL Temporary difference, when the unit has a taxable loss. It draws down an available NOL Temporary Difference when the unit has taxable income.

•The automation posts an amount as a NOL Temporary Difference with the system code NOL_SYS and the class of A. The NOL automation posts a reclass that creates the NOL Temporary difference, when the unit has a taxable loss. It draws down an available NOL Temporary Difference when the unit has taxable income.

•Selections made in the NOL Allowance rate and Base NOL Allowance impact the amount of the reclass to NOL that is posted.

•The NOL Allowance rate is the percent of taxable income/loss that should be considered when computing the NOL that should be reclassed for the specified unit.

•The Base NOL Allowance, such as the §382 limitation, limits the amount of NOL that is considered. If there is no Base NOL Allowance, the default value of zero should remain the same.

•To import information to the Automation section, complete the appropriate fields on the #S# States sheet in the Import Numbers template.

Automation

Note: In Consolidated State reports, the total NOL will not be reduced by entities that have income. To make this reduction adjustment, an elimination entity should be created with the NOL entry only.