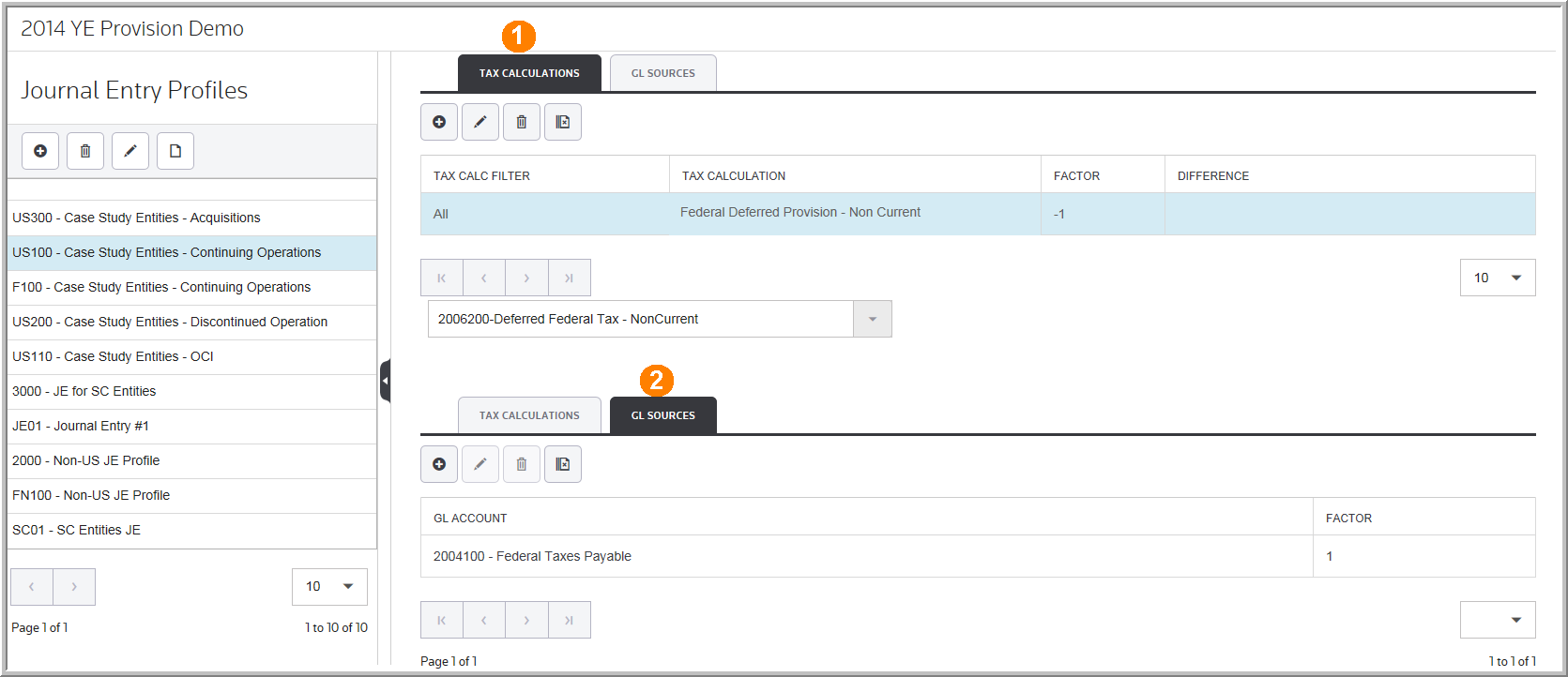

Tax Calculations & GL Sources

Tax Calculations and GL Sources allows the configuration of the components of the journal entry. You can configure the data and calculations to create the debit and credit lines making up the journal entry that is booked for tax. The factors convert the signs to achieve a debit-credit format for the journal entry. A valid journal entry requires that debits and credits equal one another.

Tax Calculations

Lets you assign tax calculations or other data in the system to create a line item in the journal entry. Factors are used to adjust the derived calculated number. Federal and State Calculations and other data can be mapped as separate lines or grouped together in one line depending on the level of detail that is in the General Ledger. Amounts displayed in the JE are in Local Currency, not Reporting Currency.

Available Calculations

•Current Tax Expense

•Current Provision - Profit & Loss

•Current Provision - Equity Offset

•Income Statement – Equity Offset

•Tax Adjustments

•Payable Balances (Federal and State)

• Provision (Total Deferred Expense: activity+deferred)

•Deferred Provision Activity (Activity only)

•Deferred Provision – Other Tax Adjustments (Deferred only)

•Balance Sheet Only Adjustments (Equity Offset)

•Deferred Tax Assets/Liabilities (Ending Balance and Starting Balance)

•Rounding (the difference caused by rounding between the Deferred Provision and the Ending Deferred Balance – Starting Balance – Balance Sheet Only Adjustments)

•Deferred Provision Related (activity, deferred only, expense, rounding)

•Balance Sheet Only Adjustments

•Deferred Tax Assets/Liabilities

•Federal Return Basis Provision

GL Sources

Lets you assign account balances from Trial Balance data that is populated in the application (typically by the bridge import). You can consider amounts previously booked in tax accounts, for prior quarters, when provision data is on a year-to-date basis. The system creates a journal entry for the incremental amount to be booked.

Tax Calculations & GL Sources

1.Use Tax Calculations to filter calculations by group and view the tax calculation list.

2.Use GL Sources to determine the account balances from Trial Balance data.