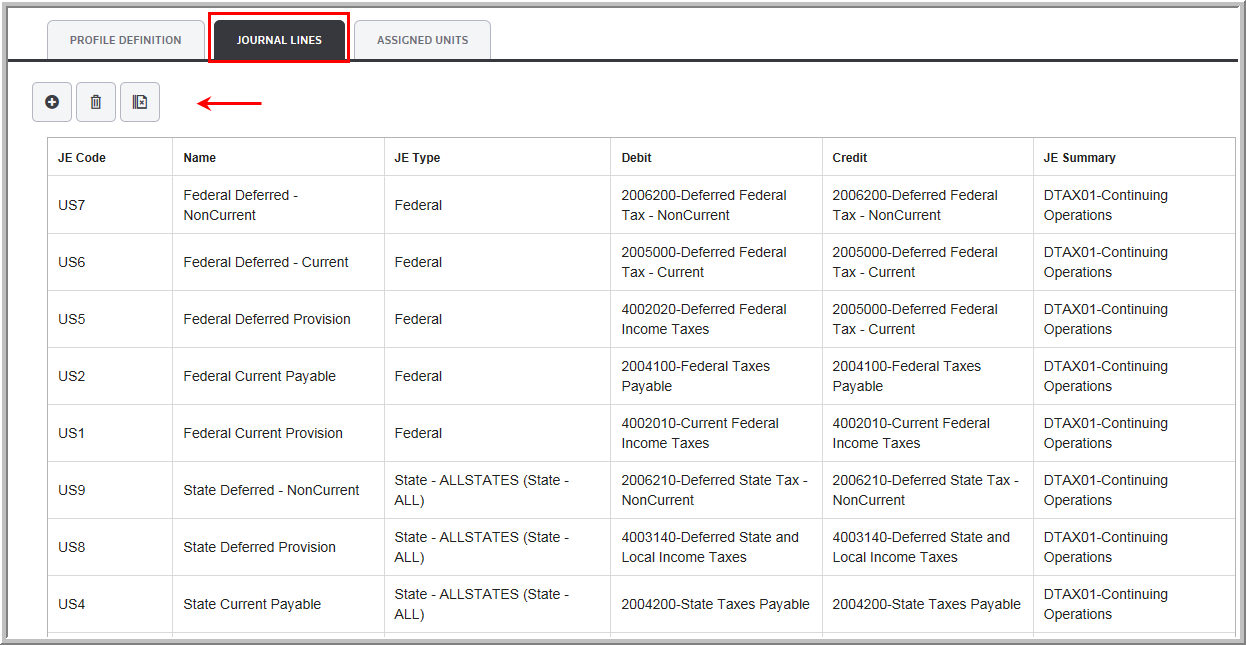

Journal Lines

1.Use Journal Lines to Add, Delete, and Copy journal entry lines.

•You configure and maintain each journal entry line separately.

oUse one or more lines to debit/credit an account.

•Provides granular components of Tax Provision Calculation.

•Allows for Summations by GL Account.

•Breaks out Federal and State (all, individual or groups) calculations.

•Provides Journal Entries by Unit and Filing Group.

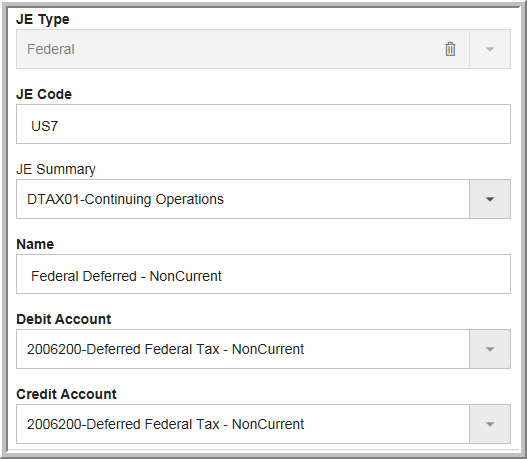

2.Use Journal Lines to determine the JE Type, JE Code, JE Summary, Name (Description), Debit Account, and Credit Account.

•JE Type: Jurisdiction or locality reference for the journal line. The options include: Federal, State - All, individual states, and state groups.

•JE Code and Description: Each JE line is determined by a user-defined Code and Name (Description). The Code and Name (Description) appear in the JE report.

•JE Summary: Custom grouping of Journal Entries. Select the JE Type then select one of the custom groups you've created from the JE Summary drop-down.

Note: JE Summary codes are optional.You are not required to have information in the JE Summary field. Select Administration > System > Journal Entry Summary to create JE Summary codes.

•Debit GL Account/Credit GL Account: Accounts from the Trial Balance Sublines where a debit or credit amount is posted in the general ledger. If the calculated amount is positive, the system uses the debit account. If the calculated amount is negative, the system uses the credit account.

Journal Lines Data

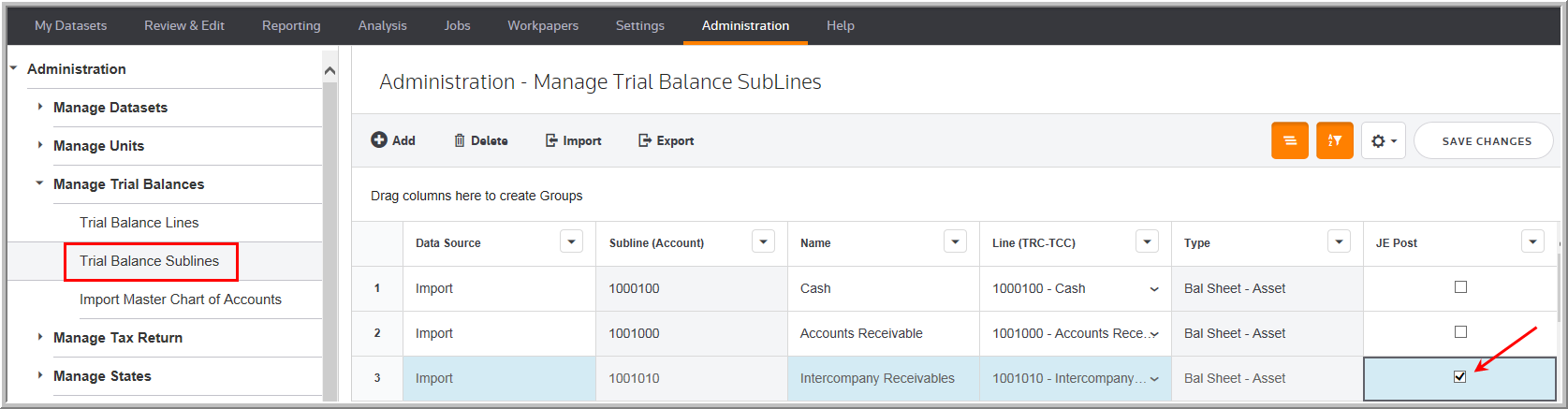

Note: To see accounts in the Debit GL Account/Credit GL Account lists, you must select the JE Post option for that subline code, when setting up the Trial Balance Sublines.

To view the accounts set up in Trial Balance Sublines select Administration > Manage Trial Balances > Trial Balance Sublines > JE Post.