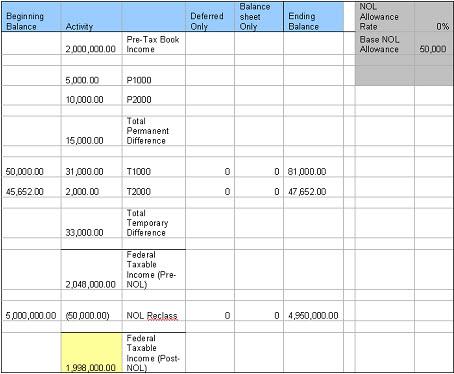

Scenario 3

When the NOL Allowance Rate is set to 0% and the Base NOL Allowance is set to 50,000, the NOL Reclass is the sum of the Base NOL Allowance (50,000), NOL Deferred Only (0), and NOL Balance Sheet Only (0).

50,000 <Base NOL Allowance> + 0<DO> + 0<Bal O> == - (50,000) <NOL Reclass>

If the NOL Reclass is added to the Federal Taxable Income (Pre-NOL), the Federal Taxable Income (Post-NOL) is 1,998,000.

2,048,000<TI Pre-NOL> + -50,000 <NOL Reclass> = 1,998,00 <TI Post-NOL>

NOL Ending Balance

(Beginning Bal + Deferred Only + Balance Sheet Only) + (NOL Reclass) = NOL End Bal

5,000,000 <BBal> + -50,000<NOL Reclass> + 0 <DO> + 0<Bal O> = 4,950,000<EB>