NOL Automation - Federal

Use the Federal NOL Automation to calculate a percentage of the current federal loss to reclass as a NOL deferred tax asset and enter the Base NOL Allowance. This option creates a Federal Only NOL adjustment while not affecting the state calculation.

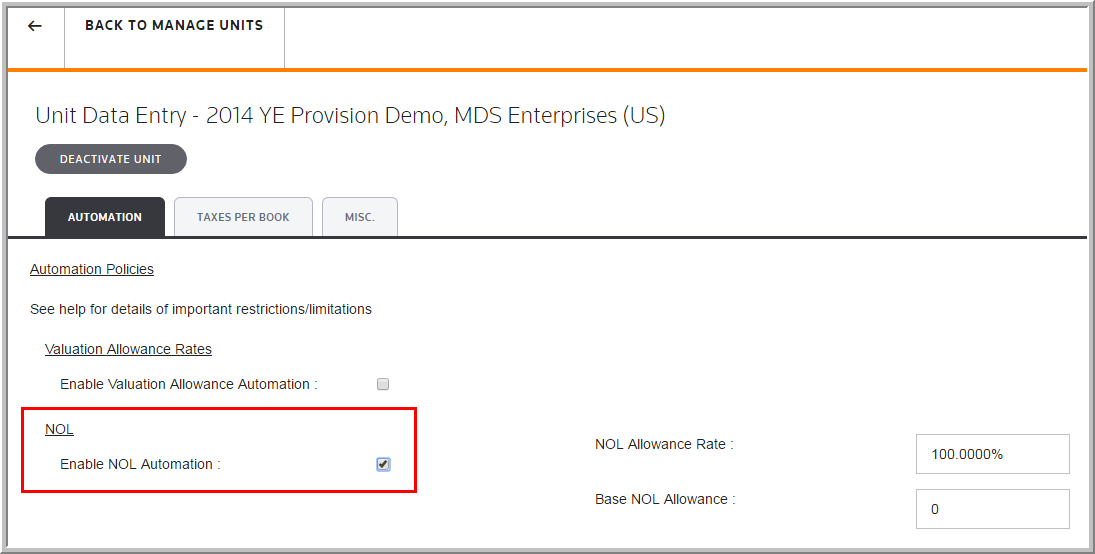

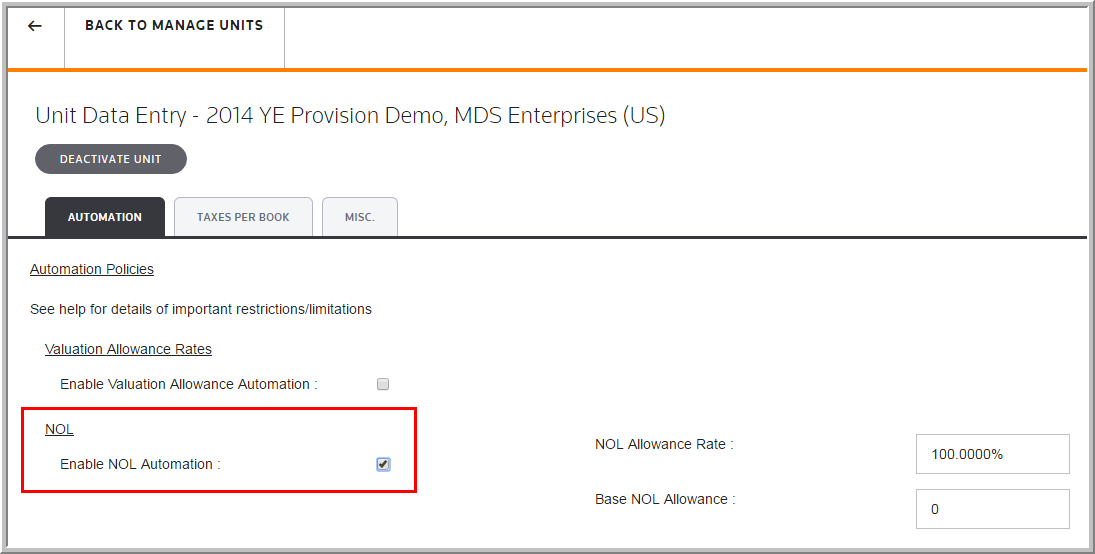

•Activate the NOL Automation by selecting My Datasets > Units > More > Other > Automation > NOL > Enable NOL Automation.

•Type the percent of the current federal income for reclassing a NOL deferred tax asset. If there is an annual NOL limitation (sec 382), type the amount in the Base NOL Allowance field. The system limits the amount used for current federal income.

•Type the annual NOL limitation amount in Base NOL Allowance. For example, your SRLY or sec 382.

Enable NOL Automation

After activating the NOL Automation, the NOL_SYS Code-Description appears in the NOL Temp Diffs - Tax Basis data entry page.

•Select Review & Edit > Data Entry > NOL Temp Diffs to manage your NOL's. Use this page to manually enter or import the Beginning Balance, Activity, Deferred Only, and Balance Sheet Only information.

Data Entry - NOL Temp Diffs