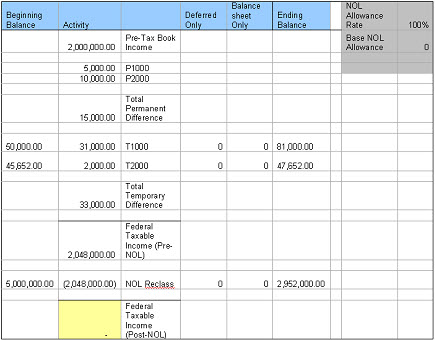

Scenario 1

When the NOL Allowance Rate is set to 100% and the Base NOL Allowance is set to 0, the NOL Reclass is the sum of 100% of the Federal Taxable Income (-2,048,000), NOL Deferred Only (0), and NOL Balance Sheet Only (0).

(2,048,000 <TI Pre-NOL> * 100%<NOL Allow Rate>) + 0 <DO> + 0<Bal O> = -(1,024,000)<NOL Reclass>

If the NOL Reclass is added to the Federal Taxable Income (Pre-NOL), the Federal Taxable Income (Post-NOL) is 0.

2,048,000 <TI Pre-NOL> + -2,048,000 <NOL reclass> = 0 <TI Post-NOL>

NOL Ending Balance

(Beginning Bal + Deferred Only + Balance Sheet Only) + (NOL Reclass) = NOL End Bal

(5,000,000 <BBal> + 0 <DO> + 0<Bal O>) + (-2,048,000 <NOL Reclass>) = 2,952,000 <EB>