Scenario 10

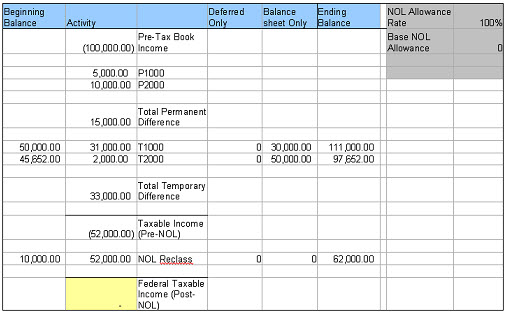

When there is a negative Federal Taxable Income (Pre-NOL), the NOL Allowance Rate and the Base NOL Allowance do not affect the NOL Reclass. This occurs because the negative Taxable Income is considered a loss and is added to the NOL Balance Sheet.

If the NOL Reclass is added to the Federal Taxable Income (Pre-NOL), the Federal Taxable Income (Post-NOL) is 0.

-52,000 <TI Pre-NOL> + 52,000 <NOL Reclass> = 0 <TI Post-NOL>

NOL Ending Balance

(Beginning Bal + Deferred Only + Balance Sheet Only) + (NOL Reclass) = NOL End Bal

(10,000 <BBal> + 0<DO> + 0 <Bal O>) + (52,000 <NOL Reclass>) = 62,000 <EB>