Parameters

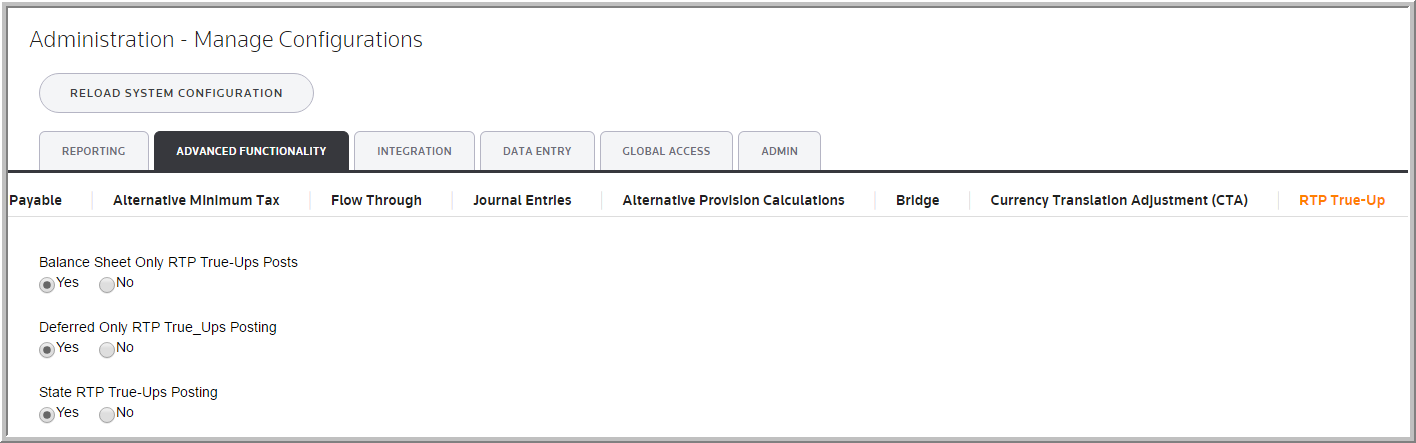

Use the following system parameters to create additional RTP true-ups by selecting Administration > System > Manage Configurations > Advanced Functionality > RTP True-Up.

•Use Balance Sheet Only RTP True-Ups Posts, and the system considers Balance Sheet Only amounts when the RTP posting functionality processes.

•Use Deferred Only RTP True-Ups Posting, and the system considers Deferred Only amounts when the RTP posting functionality processes.

•Use State RTP True-Ups Posting, and the system considers State amounts when the RTP posting functionality processes.

In addition, NC_2013_PERM and NC_2013_TEMP must be in the system for State Non-Cash Adjustments to be posted:

1.Select Administration and then Manage States.

2.Select State Tax Adjustments.

3.Type a Non-Cash Tax Adjustment for Permanent Differences; use the following format (with the appropriate year), NC_RTP_YYYY_PERM.

4.Type a Non-Cash Tax Adjustment for Temporary Differences; use the following format (with the appropriate year), NC_RTP_YYYY_TEMP.

Note: If Federal and State Tax Adjustment codes in the system, the following error message appears Posting the True-Up Adjustments requires the following Unit and State Tax Adjustment Codes be added: NC_RTP_YYYY_Temp, NC_RTP_YYYY_Perm.