What Transfers to the Estimated Payments Worksheet

Transferred Items

The Estimated Payment data received includes:

Company

The company name transfers.

Members

The members of the consolidated group transfer as a Code or Name depending on the parameter selected in Administration > System > Manage Configurations > Integration > Estimated Payments > Display Consolidated Members Code.

Unit Code

The unit code in Tax Provision will equal the Entity number in Estimated Payments.

Fiscal Type

The filing type transfers.

Fiscal Year

The Tax Year transfers.

Jurisdiction

•Fed.

•2 digit postal code.

Txn Type

Value for Transaction type will be populated in the worksheet based on the selection in Administration, within the Manage Configurations folder.

Example:

•For Fed: 1ES-F, 2ES-F, 3ES-F, 4ES-F.

•For States: 1ES, 2ES, 3ES, 4ES.

Amount (USD)

Transfers only in US whole dollars and no cents.

Txn Date

The actual transfer date is used.

FX Rate

The rate will pre-populate with the number 1.

Description

The Estimated Payment description is required.

Target Dataset with Classes

The application will utilize the class value and ignore the tag value.

Target Dataset with Tags

The tag selected in the Tag list populates the worksheet cells.

Class

The class is auto-generated as EstimPay.

Subclass

The subclass is auto-generated as Default.

To transfer data from the Estimated Payments Worksheet to data entry:

•Select Populate Data to Tax Provision.

You can review the results of the transfer in Jobs.

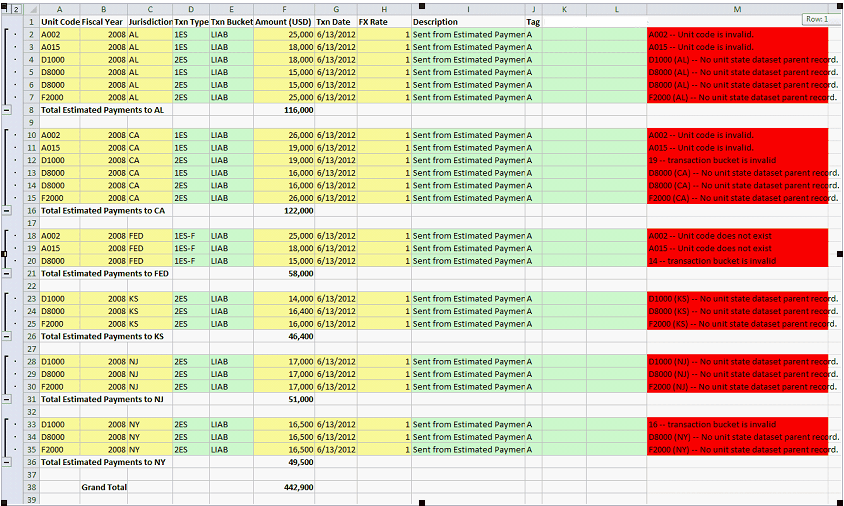

Within the Estimated Payments Worksheet, the data in the range of cells highlighted in green can be updated. However, the data in the range of cells highlighted in yellow is Read Only. After you transfer the data from the worksheet to ONESOURCE Tax Provision, review the cells highlighted in red and make the necessary corrections, then transfer the data to update the worksheet.

Note: The data transferred writes over the data previously transferred data.