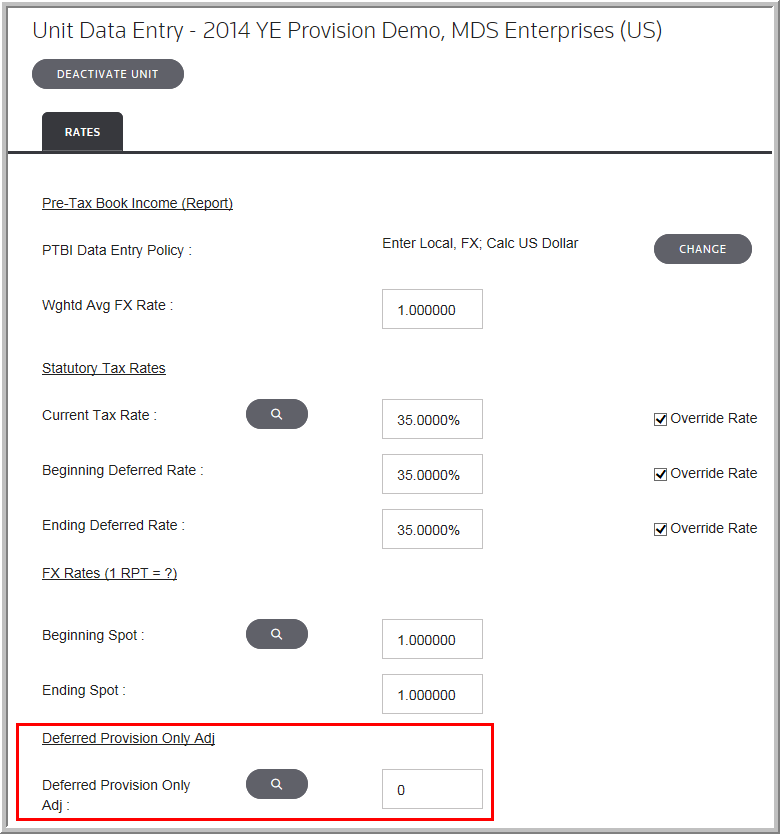

Deferred Provision Only Adjustment

The adjustment to the deferred tax provision expense is presented on the tax provision report as a separate line item and impacts the Effective Tax Rate. The deferred expense amount does not have a related deferred tax asset or liability associated with it.

•Ensure that you use this field appropriately because it may require additional support to justify the expense on the provision.

•If you utilize this adjustment additional support to justify the expense on the provision may be required.

•This field can be configured as Read-Only or removed with the system parameter.

To activate the Deferred Provision Only Adjustment functionality an administrator will need to active the following system parameter.

Select Administration > System > Manage Configurations > Other. Click Yes to activate the Deferred Provision Only Adjustment. Click No to remove the Deferred Provision Only Adjustment from the page.

Deferred Provision Only Adjustment