Custom Sub-Consolidation Reporting

Overview of Custom Sub-Consolidation (CSC) Functionality

By default, the system configures reports using the Custom Sub-Consolidation system parameters for the Tax Provision and Effective Tax Rate.

The Custom Sub-Consolidation system parameter lets you:

•View the Tax Provision and Effective Tax Rate reports at the sub-consolidated level showing Sub Consolidation, rather than Unit detail.

•Create multiple CSC groupings in the system; for example, define one CSC to view units by region and another to view units by management lines.

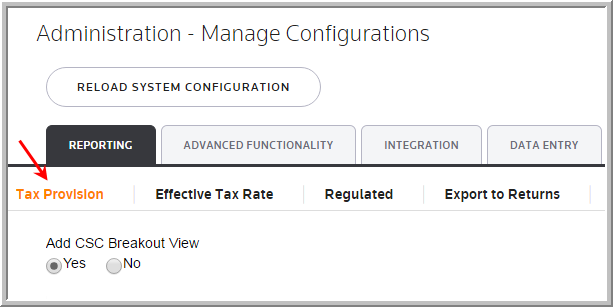

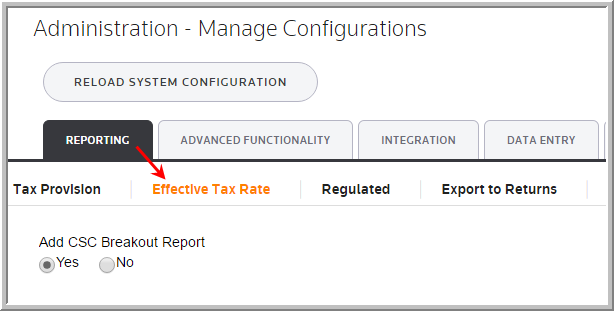

To review the parameter, select Administration > System > Manage Configurations > Reporting.

Set-up of CSC

An administrator manages the following system parameters in Manage Configurations.

•Add CSC Breakout View in the Tax Provision tab.

•Add CSC Breakout Report in the Effective Tax Rate tab.

•Add Consolidated PTBI Reconciliation in the Effective Tax Rate tab.

|

|

To create the Sub-Consolidations:

In Manage Units > Unit Sub-Consolidations, create a parent sub-consolidation beginning with CSC#_X_. You can have multiple CSC breakout's by multiple parent Sub-Consolidations (for example, CSC1_X_Regions and CSC2_X_Management). In each of the parent sub-consolidations, include all units for the child Sub-Consolidation.

•To create a parent add a Code, and Name.

In Manage Units > Unit Sub-Consolidations, create multilple child sub-consolidations starting with CSC#_ (for example, CSC1_North America and CSC1_EMEA or CSC2_Corporate, CSC2_Manufacturing).

•Include all units defined for the Parent CSC in only one Child sub-consolidation to ensure that report results are meaningful.

•To create a child add a Code, and Name.

In the following example, D1000, D2000, F1000, and F2000 can only belong to one child sub-consolidation, either CSC1_Domestic or CSC1_Foreign.

Unit Code |

CSC1 X Worldwide |

CSC1 Domestic |

CSC1 Foreign |

|---|---|---|---|

D1000 |

X |

X |

|

D2000 |

X |

X |

|

F1000 |

X |

X |

|

F2000 |

X |

X |

D1000, D2000, F1000, and F2000 can only belong to one child sub-consolidation, either CSC1_Domestic or CSC1_Foreign.

•To import, complete the appropriate fields on the #CSC# Sub-Consolidations sheet in the Import Categories template. You can create a sheet named #CSC2#, which allows the creation and population of multiple sub-consolidations for a Unit. Column A should have the Unit Code and Columns B through IV should have the CSCs in which the unit should be included. Existing unit designations in a CSC are replaced, not appended, when the #CSC2# is imported. This sheet does not export when categories are exported and is not in the standard template for import categories.

Viewing CSC Reports

•After activating parameters, the Effective Tax Rate CSC Breakout report is available.

•To display a report, be sure to select the parent sub-consolidation (for example, CSC1_X_Regions and CSC2_X_Management) in the Report Level list. The report displays a Total column and a column for each CSC.