Separate Attribute Basis

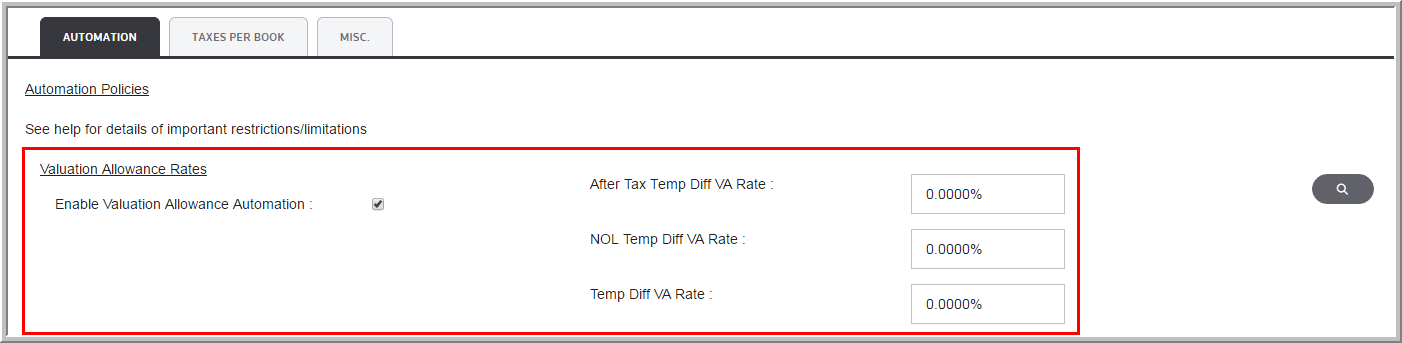

By default, the system uses the Separate Basis Valuation Allowance to calculate the valuation allowance. In the Automation page, you can enter percentages to calculate the valuation allowance for After Tax Temporary Differences, NOL Temporary Differences, and Temporary Differences.

•The functionality analyzes each of the three component types separately. For example, if balances in Net Operating Losses for the unit netted to an asset, the system posts a valuation allowance contra asset at the entered percentage for Net Operating Losses. However, if balances for the Temporary Differences for the same unit netted to a liability, the system will not post a valuation allowance.

•Current/Non-Current balances that make up the component's asset determine the designation of current or non-current status for the valuation allowance.

•For units in a filing group, the parent unit determines the valuation allowance automation and percentage for the group.