Posting the Payable Reclass

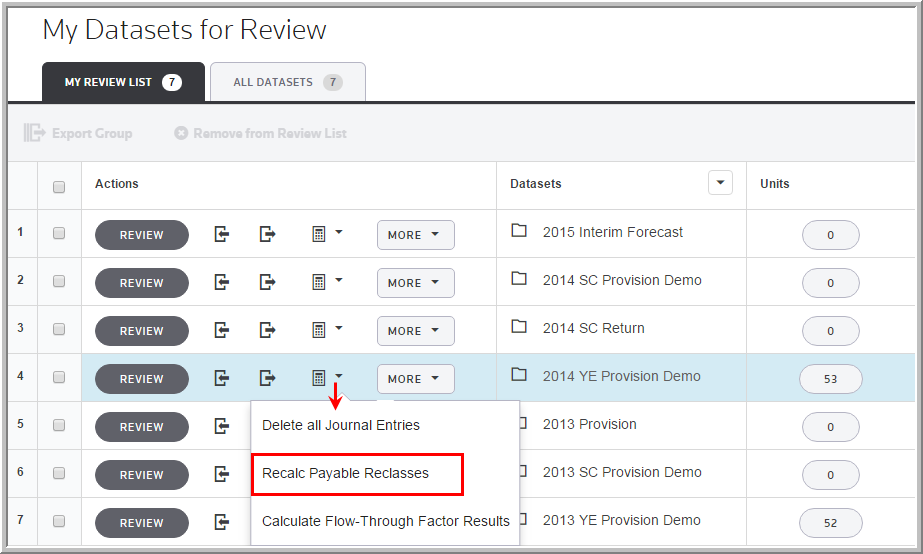

After setting up the Payable Reclass, the system posts the provision in the child unit. Review the provision amounts originally posted at the child level for accuracy. Then, select My Datasets > Calculate > Recalc Payable Reclasses.

Recalc Payable Reclasses

The reclass uses similar (but different) transaction types to move amounts between entities:

Provision Reclass

CPROV CPROV-REC

RTP RTP-REC

ATR ATR-REC

OTHER OTHER-REC

The system transfers the provision posting from the child to the parent, keeping the year level and character from the original posting. Also,

•The system removes all payable transactions, CPROV-REC, ATR-REC, RTP-REC, and OTHER-REC tagged with a C.

•The system looks for the units that have the PAYRECUNIT unit and/or state level parameters configured and creates new payable transactions that cancel out the CPROV, ATR, RTP and OTHER payable transactions posted by the Payable Auto-posting. (These are type CPROV-REC, ATR-REC, RTP-REC, and OTHER-REC tagged with a C.)

•The system creates additional payable transactions in the target units. (These are type CPROV-REC, ATR-REC, RTP-REC, and OTHER-REC tagged with a C).

See Payable Reclasses for more information about the Recalc Payable Reclasses option.