Tax Accounts Summary

Reporting Levels: |

|||||||

Unit |

Filing Group |

Sub-consolidation |

Consolidation |

||||

Reporting Configurable Options: |

|||||||

Dataset |

Unit |

State |

Sub-consolidation |

Currency |

|||

Source Data: |

|||||||

All Data Entry Pages |

|||||||

Available Views: |

|||||||

Summary, Rollforward |

|||||||

The Tax Accounts Summary Report gives you the impact of the Trial Balance and the breakout of all the different tax accounts. You can review the different tax accounts for the Balance Sheet and the Income Statement on one page. This report enables you to check the payable and ensure the movements in deferred items went to the right place. This report also helps to validate the Journal Entries. You can easily track changes for all of your tax accounts maintained in Tax Provision with the Tax Account Rollforward report.

Report Views

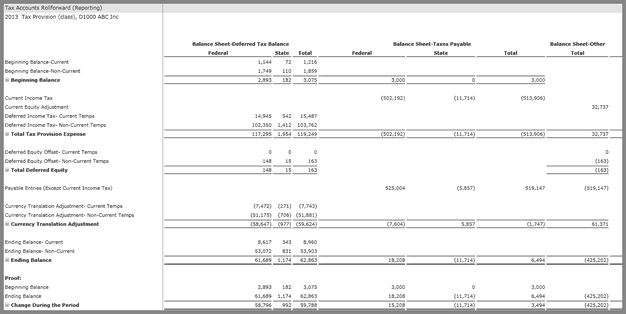

The report defaults to the Summary view. Select Rollforward view to see the detail of the change between the beginning and ending balances for the tax accounts. This view also includes a journal entry proof.

Balance Sheet

The report will show all of the impact to the balance sheet items for deferred and the current and non current breakdown. The breakdown includes the Balance Sheet for your Expense, Beginning, and Ending Balance for Current and Non-Current Deferred Income Tax for Federal, State, and Foreign.

There will be line items for Total Current Deferred, Total Non-Current Deferred, and Total Deferred.

Payable

The payable will need additional mappings set up to be complete. You have the ability to map specific payable transaction types for various accounts. This allows you to give different presentations of your data and easily verify other items that you may track separately such as Franchise Tax.

You may want to map the following items for the payable:

•Accrued Income Tax, Federal, State, and Local

•Current UTB

•Current UTB - Interest and Penalties

•Non-Current UTB

•Non-Current UTB - Interest and Penalties

All Other Payable Entries

If the mapping has not been configured then all items will go to the All Other Payable Entries.

Income Tax

The report shows the Income Statement impact of the changes in balances. The difference creates the deferred expense. The breakdown includes the Income Tax for your Expense, Beginning, and Ending Balance for Current and Non-Current Income Tax for Federal, State, and Foreign.

•There will be line items for Total Current Income Tax, Total Deferred Income Tax Current Temps, Total Income Tax Non-Current Temps, and Total Income Tax Expense.

•To the extent the that there are Balance Sheet Only items going to Equity, that data is available to review, as well.

Total Current Equity Adjustment

This line item will show the impact of the current for equity.

Total Deferred Equity Offset

This line item will show the impact of the deferred for equity.

Note: Use the Tax Account mapping at the dataset level to take a transaction type within the payable and assign it to a category. Otherwise, by default, the items appear in the All Other Payable Entries line.

Data is available from three separate reports, Tax Provision, Payable, and Deferred Balances in one report.

Tax Account Summary - Rollforward report