Simple Journal Entry (default view)

The simple Journal Entry Report is the default view of the Provision Journal Entry (simple/old) report. The simple journal entry report shows journal entries with a fixed number of book and tax accounts. The system uses the fixed set of book values for tax accounts from the Taxes Per Book page.

•The report output is in a fixed format. However, you can export it to Excel to customize the report.

•No breakout of assets/liabilities, current/non-current

•No reference to GL Accounts

•Not in Debit/(Credit) format

•Not Configurable

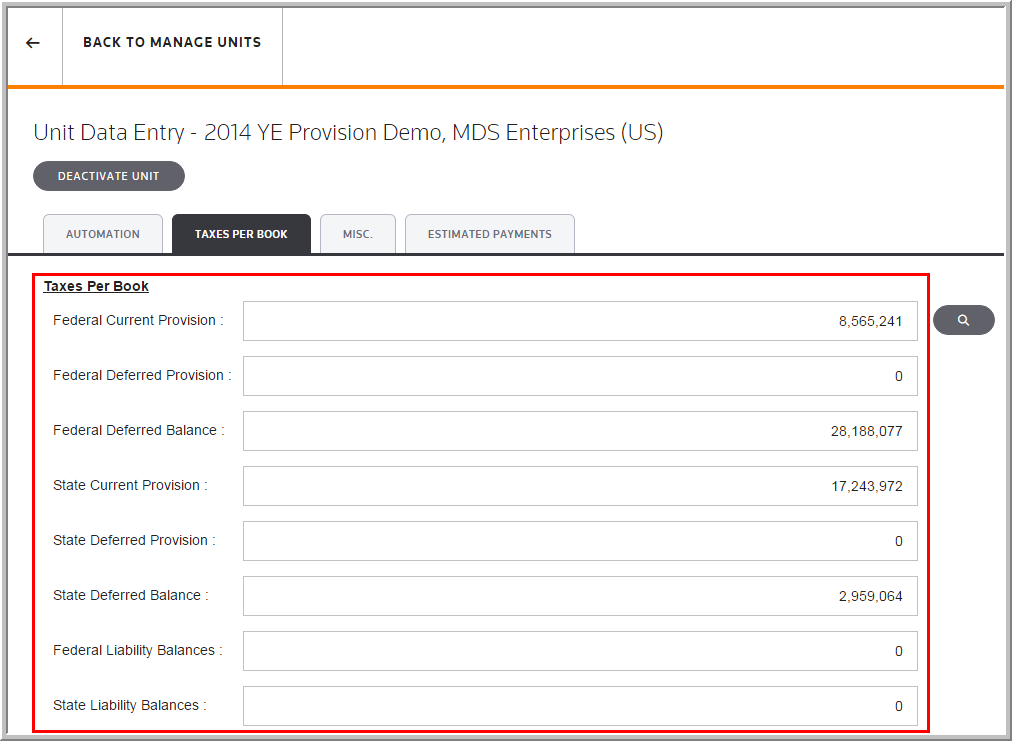

To access the simple journal data entry page select My Datasets > Units > More > Other > Taxes Per Book.

For example, the system calculates adjustments for the following book accounts:

➢Current Tax Expense is $100 on books

➢Tax Provision calculates Current Tax Provision of $106

➢Adjustment of $6 needed to Current Tax Expense

Taxes Per Book - Fixed Set of Book Values for Tax Accounts

The system creates each journal entry by comparing the following:

•ONESOURCE Tax Provision value

•Book value

•Difference: ONESOURCE Tax Provision and Book

Note: You can also view journal entry (JE) reports using configurable JE or custom JE functionality.