Reporting

You can isolate Payable Reclasses in reports by assigning transaction types to a Reclass Rollup code in Administration.

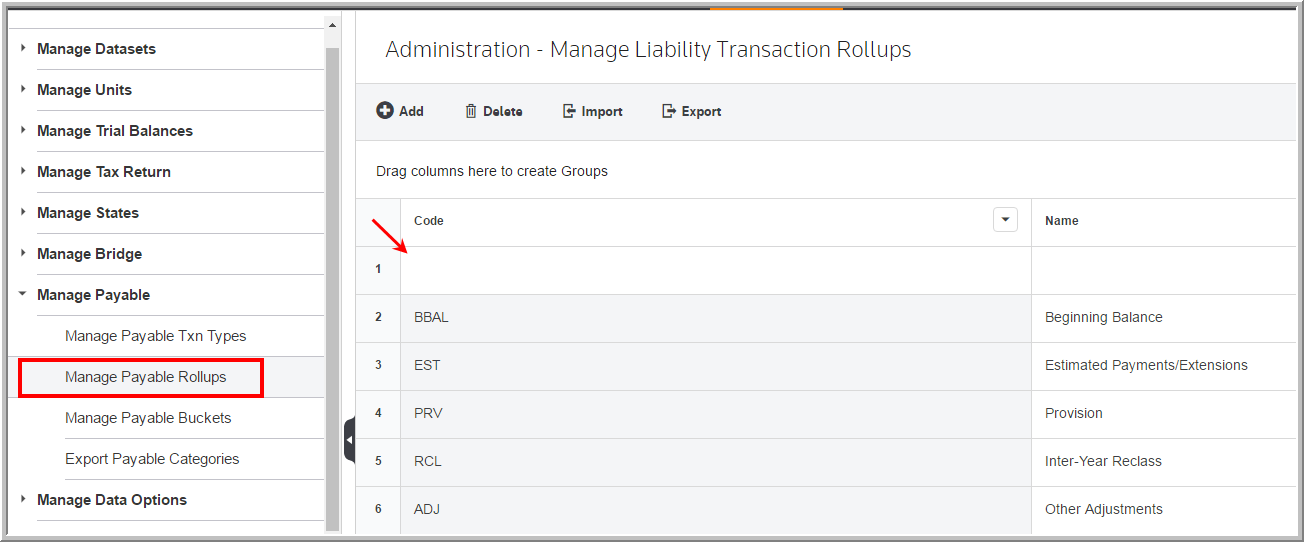

First, you create a reclass rollup code within the Manage Payable Rollups page. Select Administration > Manage Payable > Manage Payable Rollups > Add >

•Type the Code and Name.

Manage Payable Rollups

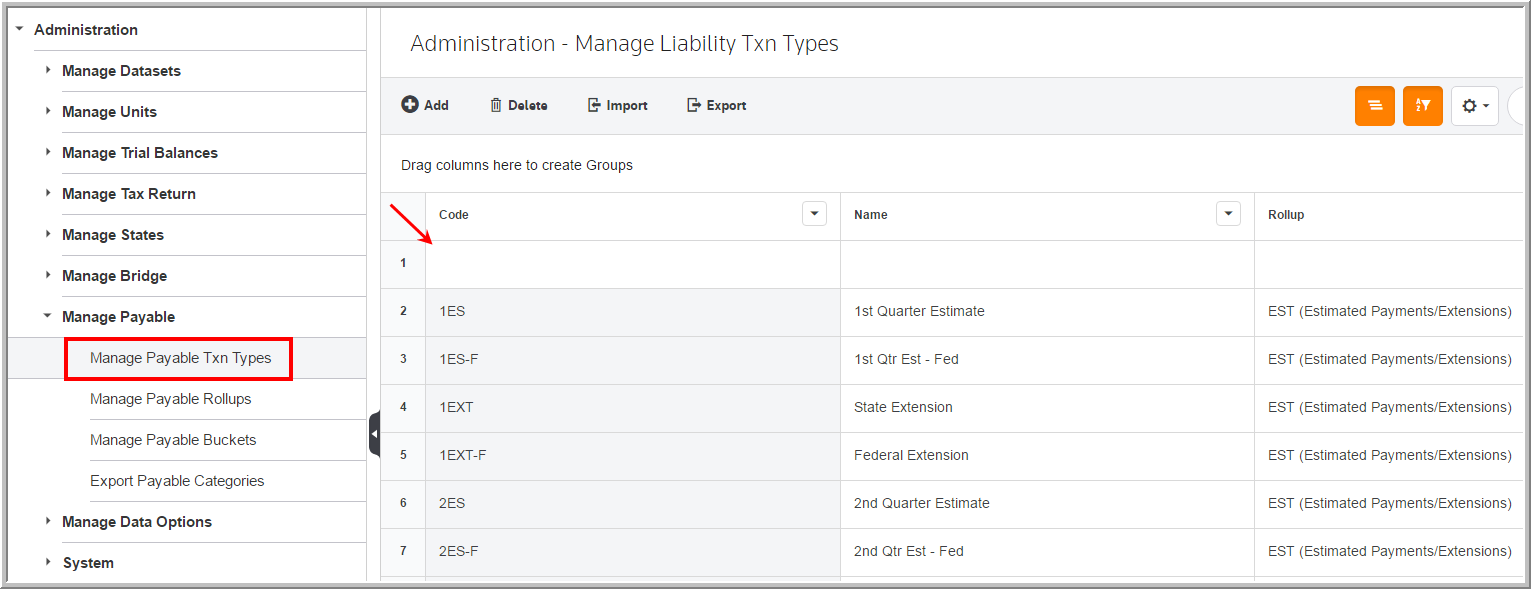

Then, assign the reclass rollup code to the following transaction types:

•CPROV-REC

•RTP-REC

•ATR-REC

•OTHER-REC

1.Select Manage Payable Txn Types and then Code.

2.Next, type the Code, the Name and then select the Rollup code.

Manage Payable Txn Types

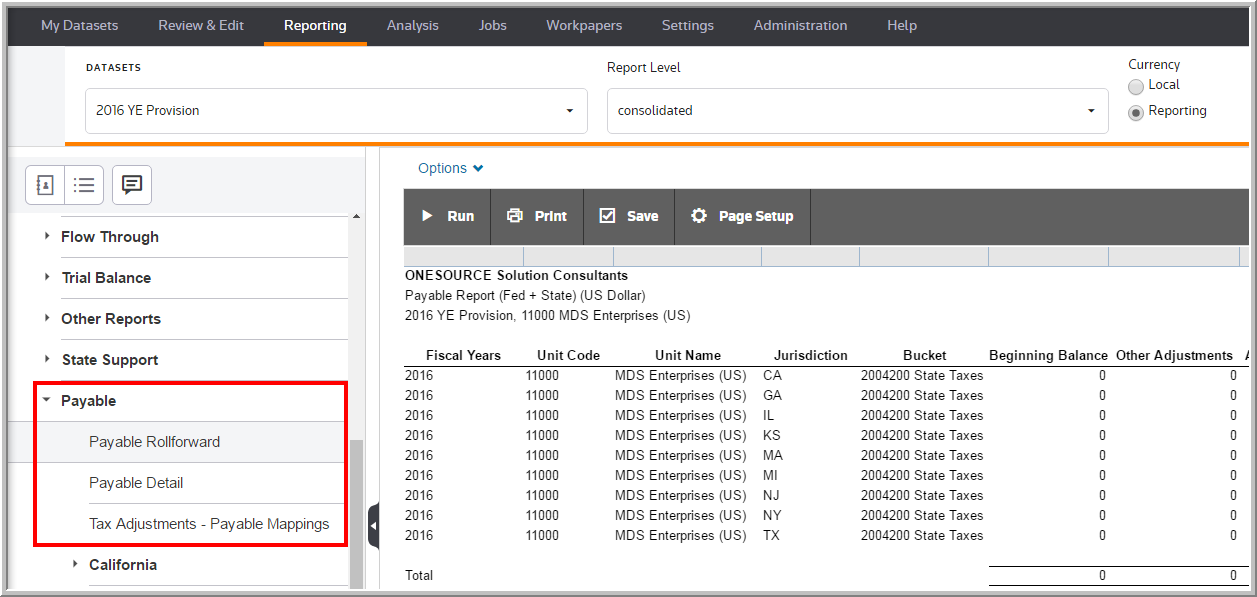

Example: Reclass on Payable Rollforward

Outside of Dataset Years

The default configuration when using the Payable module assumes that the user is a calendar year taxpayer and that payments and transactions are limited to the current year or period. The system designates the current year and current period by using the settings assigned when creating the dataset. For example, if you create a dataset as a 2015 Full Year Dataset, the system does not let you to enter transactions with a date of 1 January 2016 or greater. If the dataset is a 2016 First Quarter dataset, you can enter transactions between 1 January 2016 and 31 March 2016.

To enable greater flexibility when using the Payable Reclass functionality, you can deactivate this constraint and enter or import data outside the dataset ranges. To disable the time constraint, activate the system parameter in Administration > System > Manage Configurations > Advanced Functionality > Payable > Limit Payable Date Range > Yes.