Option 1 - Scenario B Reports

The CTA is in the Tax Provision report. It is used to calculate the Deferred Tax Provision.

Expanded B/S

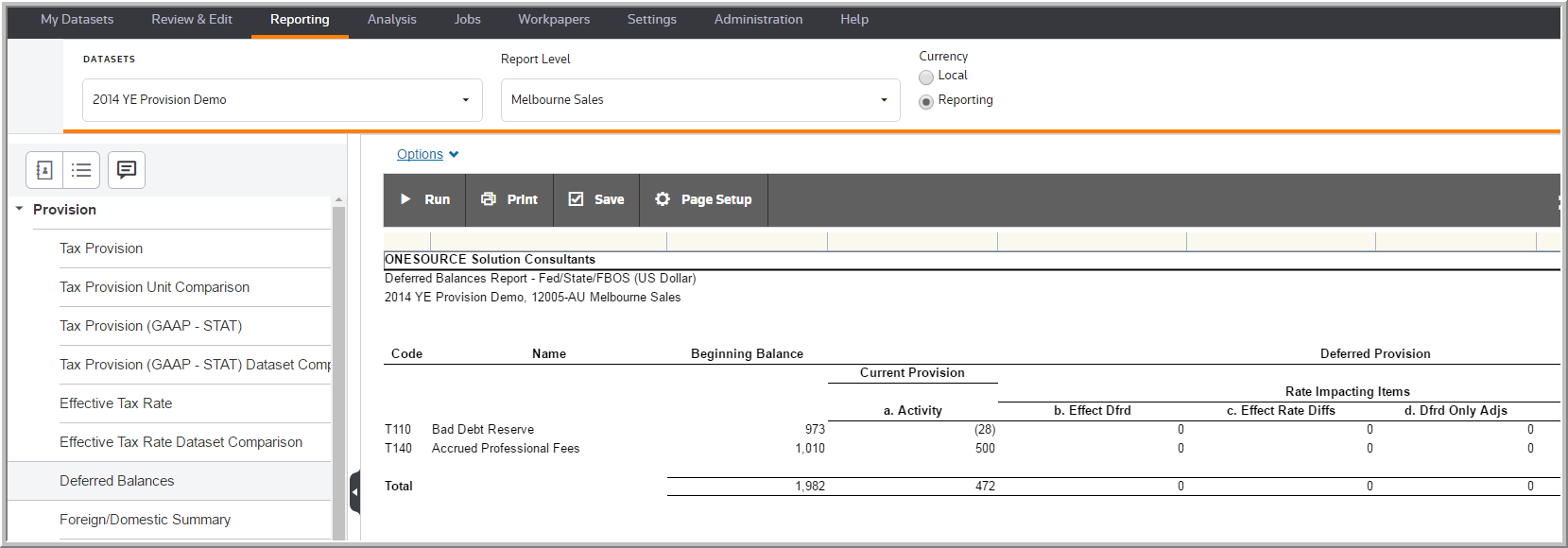

The CTA calculation can be viewed in the Deferred Balances Report (cir expanded b/s).

Expanded I/S

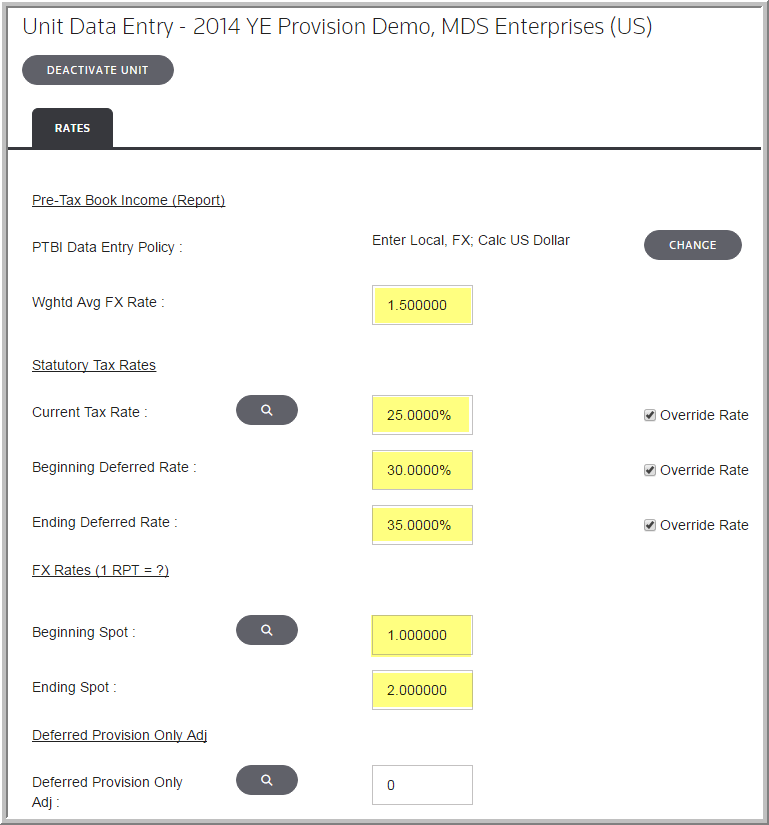

In the Expanded I/S report, you can view the impact of the CTA through Activity, the Deferred Rate Change, the Rate Difference between Current and Deferred, and Deferred Only Adjustments.