Option 1 - Scenario A Reports

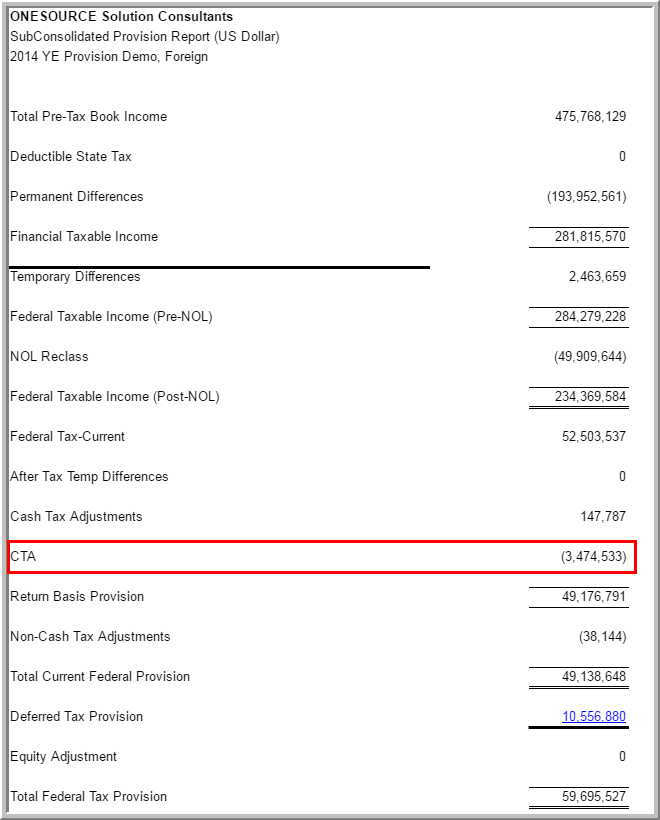

The CTA is in the Tax Provision report. It is used to calculate the Deferred Tax Provision.

Expanded B/S

The CTA calculation can be viewed in the Deferred Balances Report (cir expanded b/s).

Expanded I/S

The CTA calculation can be viewed in the Deferred Balances Report (expanded i/s).

Note: You can set corresponding relationships between tag letters and report columns by selecting Administration > System > Manage Deferred Rollforwards.