Example - Journal Entry Calculations

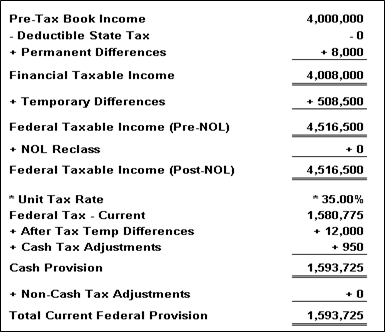

Current Provision Journal Entry |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

|

Journal Entry Calculation (B/S) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

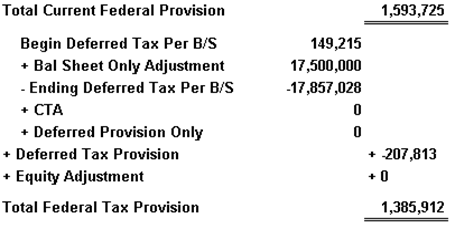

Deferred Tax Provision

|

Journal Entry Calculation (I/S) |

|---|

|

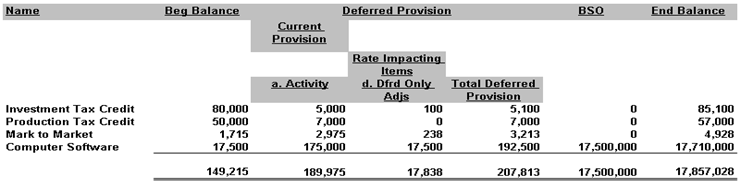

Total Deferred Provision

|

Debits |

Credits |

Deferred Tax Asset/Liability |

207,813 |

|

Deferred Tax Expense |

|

207,813 |

Deferred Provision Journal Entry (b/s approach) |

Deferred Provision Journal Entry (I/s approach) |

||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|