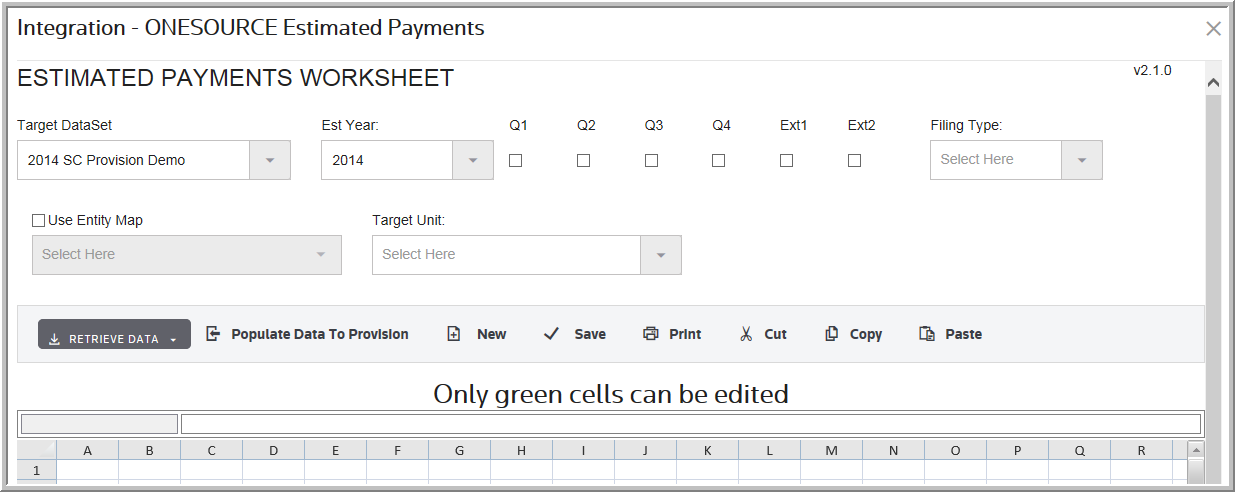

Estimated Payments Worksheet

The Estimated Payments Worksheet is a staging area for the ONESOURCE Estimated Payments data. Once you define the Estimated Payments Worksheet and transfer the data, the Estimated Payments Worksheet acquires several tabs, each tab reflects the data that transferred.

•You can transfer deductible, state tax balances from ONESOURCE Tax Provision to ONESOURCE Estimated Payments.

•Using the ONESOURCE Tax Provision fiscal year you can designate the voucher year in ONESOURCE Estimated Payments, if that year is different from the dataset year.

•You can choose Consolidated, Separate, or Both as a Filing Type. If you select Consolidated, a Target Unit list appears for you to select the Target Unit.

•When the Target Dataset type is a Tag dataset, a Tag list is available for you to select a Tag as your data source.

•To show the Consolidated Members Code in the Estimated Payments Worksheet, you must activate a new parameter called Display Consolidated Members Code.

Note that to make the members codes for the consolidated group appear in column B in the ONESOURCE Estimated Payments Worksheet, you must activate the parameter called Display Consolidated Members Codes. The Display Consolidated Members Codes parameter appears in the Integration tab of Administration- Manage Configurations, in the Estimated Payments secondary tab.

The Estimated Payment Worksheet allows you to transfer the estimated payment balances for selected Quarters by Jurisdiction and to update the taxes payable.

Accessing the Estimated Payments Worksheet

1. Select My Datasets and then Import.

2. Click ONESOURCE Estimated Payments. The Estimated Payments Worksheet opens.

3. Verify that the Target Dataset is correct.

•The transferred value from ONESOURCE Estimated Payments appears on the Federal/State Payable page within the Target Dataset.

4. Review the Year.

•The year can be changed if needed.

5. Click Quarter or Extension.

•The application retrieves data based on the year selected.

•You must select at least one quarter or extension in order to transfer the data.

6.Select the Filing Type.

•Select Consolidated, Separate or Both.

7.For Separate filing type, click Use Entity Map and then choose a map.

•An Entity Map is created between ONESOURCE Estimated Payments entities and ONESOURCE Tax Provision units by and administrator on ONESOURCE platform.

•If you apply the same code for entities in the ONESOURCE Estimated Payments and units in the ONESOURCE Tax Provision, you don’t need to apply an entity map.

8.If the Target Dataset is a tag dataset, choose a Tag.

9.For Consolidated or Both filing types, choose a Target Unit.

•The Target Unit selected will be the Unit in ONESOURCE Tax Provision that the information for the consolidated members get transferred into from ONESOURCE Estimated Payments.

Notes:

•At least one Quarter or Extension must be selected in order for the data to transfer.

•The Use Entity Map is not available prior to the 2013 release. The Unit number and Unit name in Tax Provision must match the Entity number, and Entity name in Estimated Payments and then the mapping is automatic.

•When you select Retrieve State Payments, all state data will transfer from Estimated Payments to Tax Provision.

•The States must be activated before you populate the data to the Tax Provision for States.

10.Click Retrieve Data and select one of the options:

•Retrieve State Payments.

•Retrieve Federal Payments.

•Retrieve State and Federal Payments.

ONESOURCE Estimated Payments Worksheet - Filing Type, Tag and Target Unit