Deferred Book/Tax Detail

The Deferred Book/Tax Detail report has the ability to track the book/tax deferred balances for all temporary differences. The report shows the book and tax detail for the items entered for temporary differences on a book/tax basis or entered on a tax basis. The report will tie to other deferred reports.

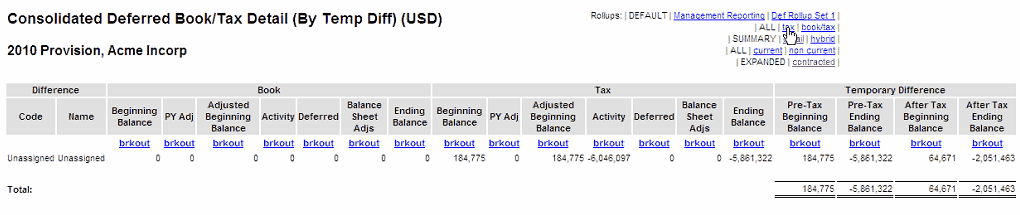

The report displays the Code, Name, as well as the Book entries for the Beginning Balance to the Ending Balance, all pre rate. Also, the report displays the Tax entries for the Beginning Balance to the Ending Balance as well as the Temporary Difference entries in Pre-Tax Beginning Balance, Pre-Tax Ending Balance, After Tax Beginning Balance, and After Tax Ending Balance.

You can view the report in the ALL, tax, and book/tax basis views and sort by the different types. The report displays the After Tax Temporary difference and a different view for deferred balances to track book/tax basis balances.