Change in Rate and Currency Translation

Deferred Balances Report in the Expanded (Balance Sheet) View

•Beginning Balance column balances are converted using the Beginning Spot rate and the Beginning Tax rate.

•The Rate Change column creates an adjustment to restate the Beginning Balance column at the Ending Spot rate and the Ending Tax rate.

•All other Columns are converted using the Ending Spot rate and the Ending Tax rate.

•The Ending Balance is the sum of the columns and is effectively the Ending Balances converted using Ending Spot Rate and the Ending Tax rate.

Deferred Balances Report in the CIR Expanded (Balance Sheet) View

•The Rate Change column is broken out into FX Rate Change and Def Rate Change.

•The FX Rate Change is the impact of the FX rate change on the beginning balance, including the impact of any FX rate change from a change in the deferred rate.

•The Deferred Rate Change is the impact of the deferred rate change on the beginning balances.

•More detail on each of the rate change activities can be displayed by viewing the Deferred Balances report in the Expanded (Income Statement) view.

FX Rate Change

The FX Rate Change is the impact of the FX rate change on each of the beginning balances, including the impact of any FX rate change from a change in the deferred rate:

(Beginning Balance / Beginning FX Spot Rate)

– (Beginning Balance / Ending FX Spot Rate)

+ (Beginning Balance X (Ending Deferred Rate – Beginning Deferred Rate) / Ending FX Spot Rate)

– (Beginning Balance X (Ending Deferred Rate – Beginning Deferred Rate) / Weighted Avg FX Rate)

Def Rate Change Computations

The Deferred Rate Change is the impact of the deferred rate change on each of the beginning balances. [((Beginning Balance X Ending Deferred Rate) / Weighted Avg FX Rate) – ((Beginning Balance X Beginning Deferred Rate) / Weighted Avg FX Rate)].

Deferred Balances Report in the Expanded (Income Statement) View

•Currency Translation Adjustment.

•Deferred Balances in USD are translated from Local Currency Balances using the Beginning and Ending Spot FX Rates.

•USD Change in Deferred Balances.

•Deferred Expense in USD is translated from the Local Currency Activity using Weighted FX Rates

•USD Deferred Expense

•Currency Translation Adjustment Computation

•Adjusts the Weighted Average FX Impact and the Ending Spot FX Rate

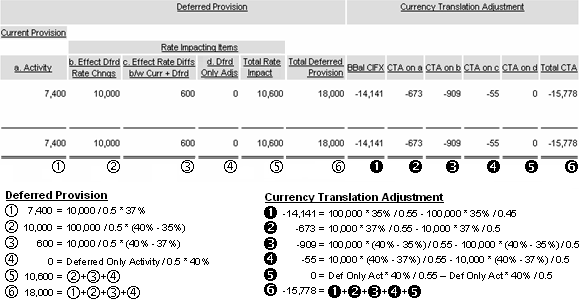

Detail of CTA Calculation Components

Information for the Calculation |

|||

|---|---|---|---|

Beginning Temporary Difference Balance |

100,000 |

||

|

|||

Temporary Difference Activity |

10,000 |

||

Beginning FX Spot Rate |

0.45 |

Current Tax Rate |

37% |

Ending FX Spot Rate |

0.55 |

Beginning Deferred Tax Rate |

35% |

Weighted Average FX Rate |

0.50 |

Ending Deferred Tax Rate |

40% |