Alternative Minimum Tax

The system can automatically calculate and post the Alternative Minimum Tax (AMT) amount using information within data entry and rate fields. The AMT calculated result posts as an After Tax Temporary Difference - Tax Basis with the adjustment code AMT_SYS. It does not take into consideration the calculation going into a recapture position.

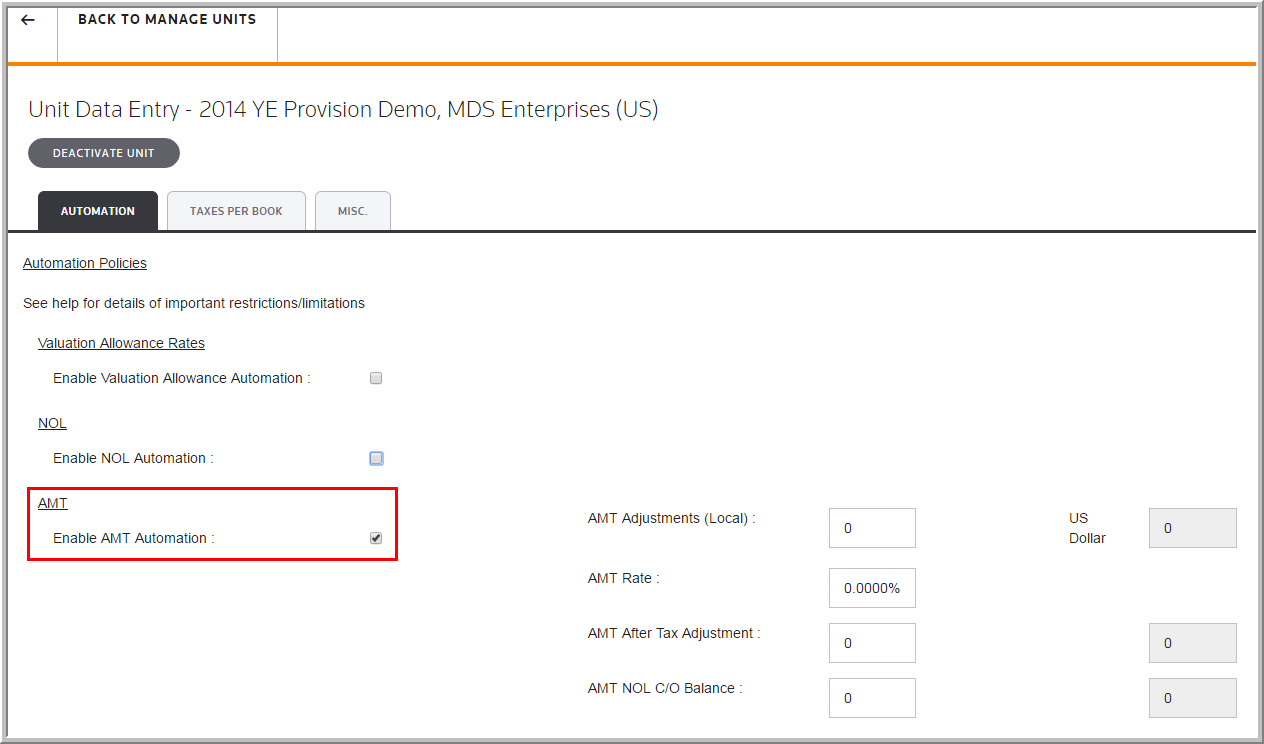

•Activate Automation policies for a unit by selecting My Datasets > Units > More > Other > Automation > Enable AMT Automation.

•Type the AMT Adjustments (Local), AMT Rate, AMT After Tax Adjustment, and AMT Net Operating Loss Carryover Balance.

•The system calculates the AMT Automation using the Reporting Currency or Local Currency approach.

•Use the system or dataset parameter to determine the approach. Using the dataset parameter, lets the system calculate the AMT Automation on a dataset-by-dataset basis.

Notes:

•The system uses the NOL_SYS code for the Federal NOL automation. To add the code select Administration > Manage Units > NOL Temp Differences.

•Use the dataset parameter, USE_OLD_AMTESTIMATOR, and the parameter value 1 to override the Reporting/Local Currency approach.

Alternative Minimum Tax (AMT) - Automation